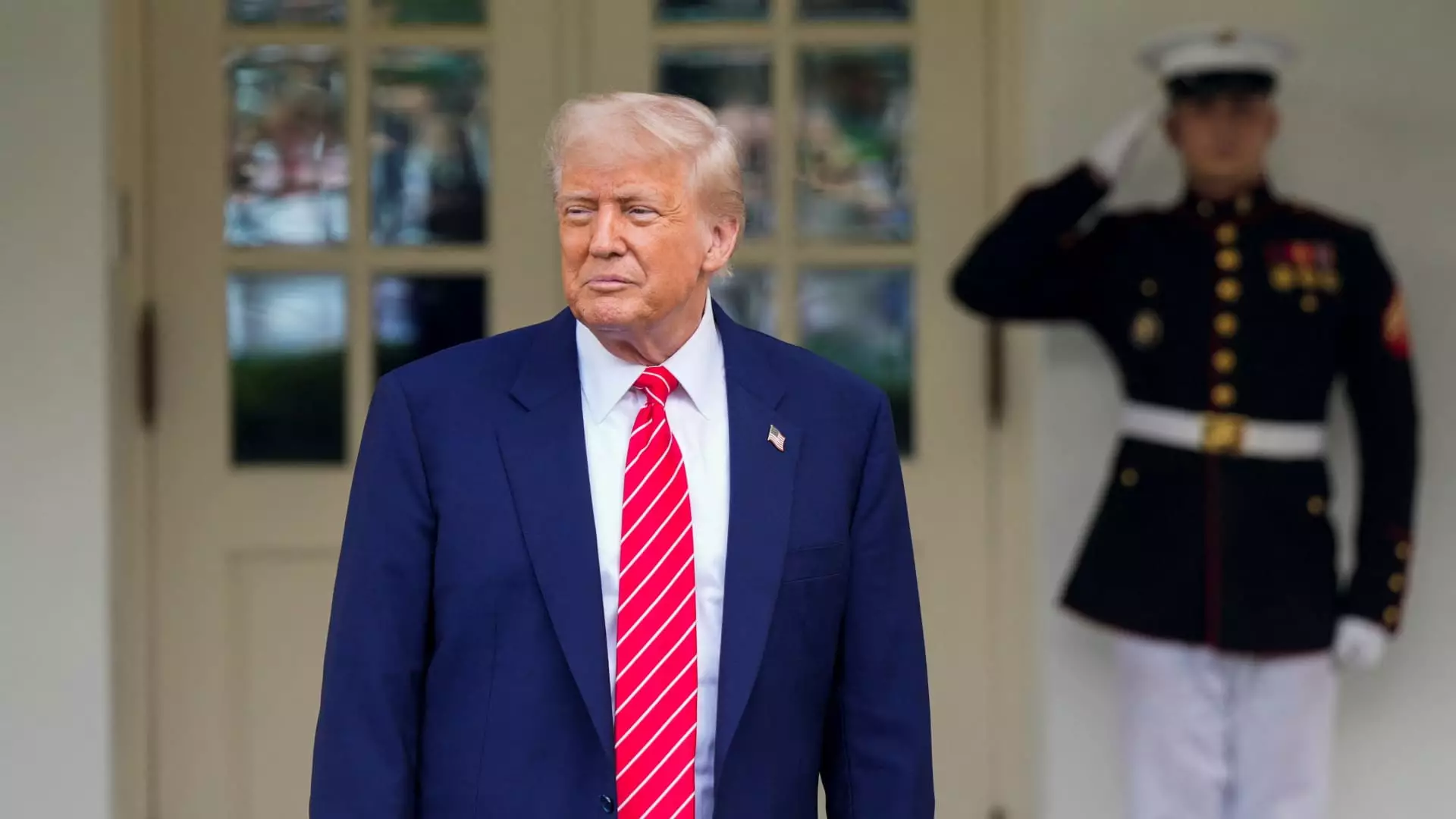

The intersection of politics and cryptocurrency has long been fraught with tension and uncertainty, but the current landscape illustrates how one individual’s actions can obstruct progress. In the wake of President Donald Trump’s involvement in the cryptocurrency sphere, the much-anticipated GENIUS Act—a bill aimed at establishing federal regulations for stablecoins—has been effectively quashed. The situation raises not only concerns about governance but casts a long shadow over the integrity of democratic processes.

Trump’s Self-Interest: A Major Obstacle

One significant barrier to the passage of the GENIUS Act is the perception of Trump’s personal interests as a lurking conflict. The president has launched his own cryptocurrency ventures, including the $TRUMP token, which raises fundamental questions about whether he can act in the greater interest of the public while simultaneously lining his own pockets. As Senator Jeff Merkley aptly pointed out, Trump’s financial entanglements present a “profoundly corrupt scheme” that not only threatens national security but also diminishes the public’s faith in governmental institutions. The implications of a president promoting personal coin offerings while negotiating national policies raise ethical alarms that cannot be ignored.

The Fallout from a Biased Agenda

The fallout from this conflict of interest has proven detrimental to efforts that might have seen bipartisan support. Prior to Trump’s notable interference, a faction of Senate Democrats appeared willing to collaborate on stablecoin legislation, viewing it as a much-needed step toward clarity in the cryptocurrency marketplace. However, once Trump’s viable personal stakes became evident, that bipartisan spirit faltered. Politicians like Senator Lisa Blunt Rochester publicly expressed her concern over Trump’s self-dealing, showcasing how personal interests can derail what should be collective progress.

What should have been a straightforward legislative process has transmuted into a political battleground. A group of nine Senate Democrats, once supportive of the bill, rescinded their backing, instead calling for more stringent regulations and measures to enhance national security. This reluctance is a clear indication of how Trump’s financial interests exacerbate existing political divisions, making it increasingly difficult for even well-intentioned bipartisan legislation to gain traction.

A Threat to the Future of Crypto?

The ramifications extend beyond the immediate failure of the GENIUS Act. Investors and tech entrepreneurs in the cryptocurrency industry are feeling the consequences of this discord. Ryan Gilbert, the founder of Launchpad Capital, candidly stated that it is “unfortunate that personal business is getting in the way of good policy.” This sentiment resonates with many who see Trump’s behavior as a hindrance to innovation and growth within a burgeoning market that has the potential to enhance the U.S. economy.

Trump’s actions may lead the U.S. to lose its competitive edge in the global crypto landscape, potentially placing it behind countries with more progressive regulatory frameworks. Continued stunted progress could render the American cryptocurrency industry a mere laughing stock on the world stage. Imagine the discouragement faced by startups and investors who are eager to partake in what they see as a revolutionary new frontier, only to find themselves stymied by the very leadership supposed to champion their cause.

Calls for Investigation

In light of these conflicts, the demand for accountability is intensifying. Senator Richard Blumenthal is not merely critiquing; he’s calling for an investigation into Trump-linked coins and demanding financial records from World Liberty Financial. Such actions reveal a bipartisan recognition that the integrity of legislative procedures must be upheld, even when leadership eliminates viable paths toward constructive dialogue.

Moreover, public servants like Senator Elizabeth Warren are intensifying scrutiny of economic disparities exacerbated by cases of conflict of interest, demanding that policymakers strictly separate personal gain from public service. While these are steps in the right direction, it remains to be seen whether they can outmaneuver the incumbent administration’s financial intrigues.

The Illusion of Progress

While conflicting business interests snag legislative progress, they also create an illusion—an appearance of movement without tangible outcomes. The mainstream narrative suggests that crypto regulation is a hot topic, and yet, meaningful reforms remain elusive. Politicians may deliver speeches and propose bills, but when the core concern remains Trump’s financial stakes, the general public becomes weary. This undercurrent of skepticism surrounding political priorities could undermine public support for both investment in cryptocurrency and overall trust in leadership.

Ultimately, as long as personal interests overshadow public discourse, the endeavor to establish effective cryptocurrency legislation will remain an uphill battle. The specter of conflict looms large, and until leadership can prioritize systemic integrity over personal profit, the dream of a sustainable regulatory framework remains just that—a dream. As the crypto community looks for advocates in government, Trump’s self-serving actions serve as a stark reminder of the real obstacles ahead.