In a significant development reflecting escalating tensions over technology and national security, the U.S. government has directed Taiwan Semiconductor Manufacturing Company (TSMC) to cease shipments of advanced semiconductor chips to Chinese clients. This directive, effective from a Monday, has been imposed by the U.S. Department of Commerce and particularly targets chips designed with 7 nanometer technology and more sophisticated architectures. These chips are notably integral to powering applications within the realm of artificial intelligence (AI), including critical components like AI accelerators and graphics processing units (GPUs).

This unprecedented action emanates from concerns regarding the potential usage of these advanced chips in technologies that the U.S. perceives as threats to its national security. Recently, TSMC’s components were discovered within a Huawei AI processor, which raised alarms and initiated this round of restrictions. The finding substantiates ongoing worries over tech companies inadvertently assisting organizations on the U.S. trade blacklist, with Huawei being a canonical example of such entities.

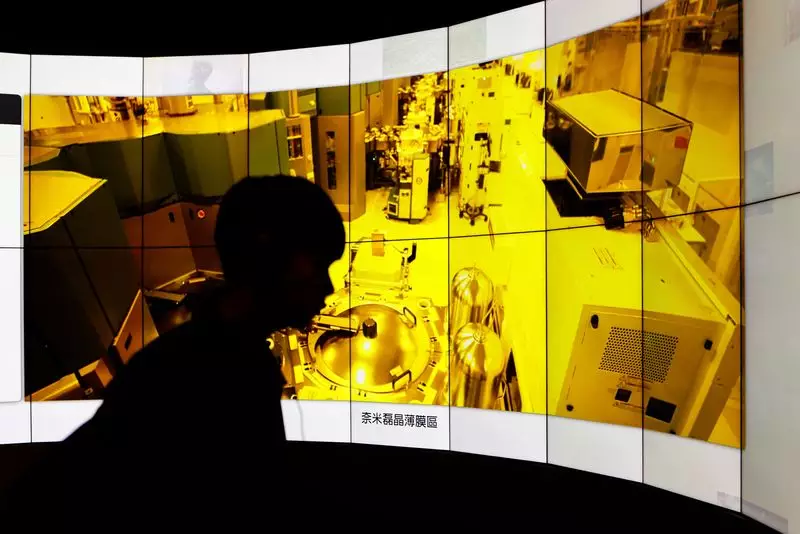

As a giant in the semiconductor industry, TSMC’s compliance with U.S. directives poses significant strategic implications for both the Taiwanese firm and its Chinese clientele. The company’s decision to halt shipments comes not just as a regulatory compliance measure but as a reflection of the complex web of global supply chains where technology and geopolitics intersect. While TSMC has traditionally prided itself on being a lawful entity, its dependency on U.S. technology and regulations complicates its operations within the burgeoning Chinese semiconductor landscape.

In light of these restrictions, the Chinese tech sector faces an uphill battle. Companies like Huawei, which heavily rely on advanced chips for their AI technologies, would likely find themselves hampered in their quest to compete on a global platform. The immediate cessation of shipments not only disrupts their production but may also stifle innovation within a sector that has been rapidly evolving in recent years. Moreover, the ongoing scrutiny on the potential diversion of chips to Huawei will further strain relationships between Chinese design firms and their Taiwanese suppliers, leaving many companies uncertain about their operational future.

The recently imposed restrictions are reflective of a broader trend in U.S. policy aimed at tightening export controls to safeguard national interests and counteract perceived competitive threats from China. Legislative pressures from both sides of the political aisle have fueled concerns that previous measures to regulate technology transfers to China have been too lenient. Lawmakers are increasingly vocal regarding the need for robust export controls, especially in the semiconductor domain, which many view as a vital battleground for future technological supremacy.

Historically, the U.S. has displayed a willingness to respond reactively to perceived threats. Actions such as the restrictions placed on companies like Nvidia and AMD, limiting their exports of top-tier AI chips, align with this proactive stance. Notably, the U.S. Department of Commerce had previously communicated similar restrictions to the semiconductor ecosystem, indicating a demonstrable pattern of regulatory oversight aimed at curtailing Chinese technological advancements.

As global attention remains focused on this high-stakes technology rivalry, the future looks uncertain for both TSMC and Chinese firms. Although the Biden administration has shown intentions to finalize new rules for the semiconductor sector, frequent delays in implementation have cast shadows on the efficacy of such initiatives. Future interactions between U.S. tech firms and their Chinese counterparts will likely remain marred by apprehension and regulatory hurdles, restricting the fluidity of international trade in technology.

The U.S.’s recent decisions regarding semiconductor exports to China not only underscore the importance of chip technology in modern geopolitical conflicts but also illuminate the broader implications for global supply chains and innovation. As tensions persist and the tech landscape continues to evolve, all stakeholders—including governmental bodies, corporations, and international organizations—must remain vigilant in navigating the intricate dynamics at play in the semiconductor arena. The unfolding narrative will undoubtedly have lasting repercussions for years to come.