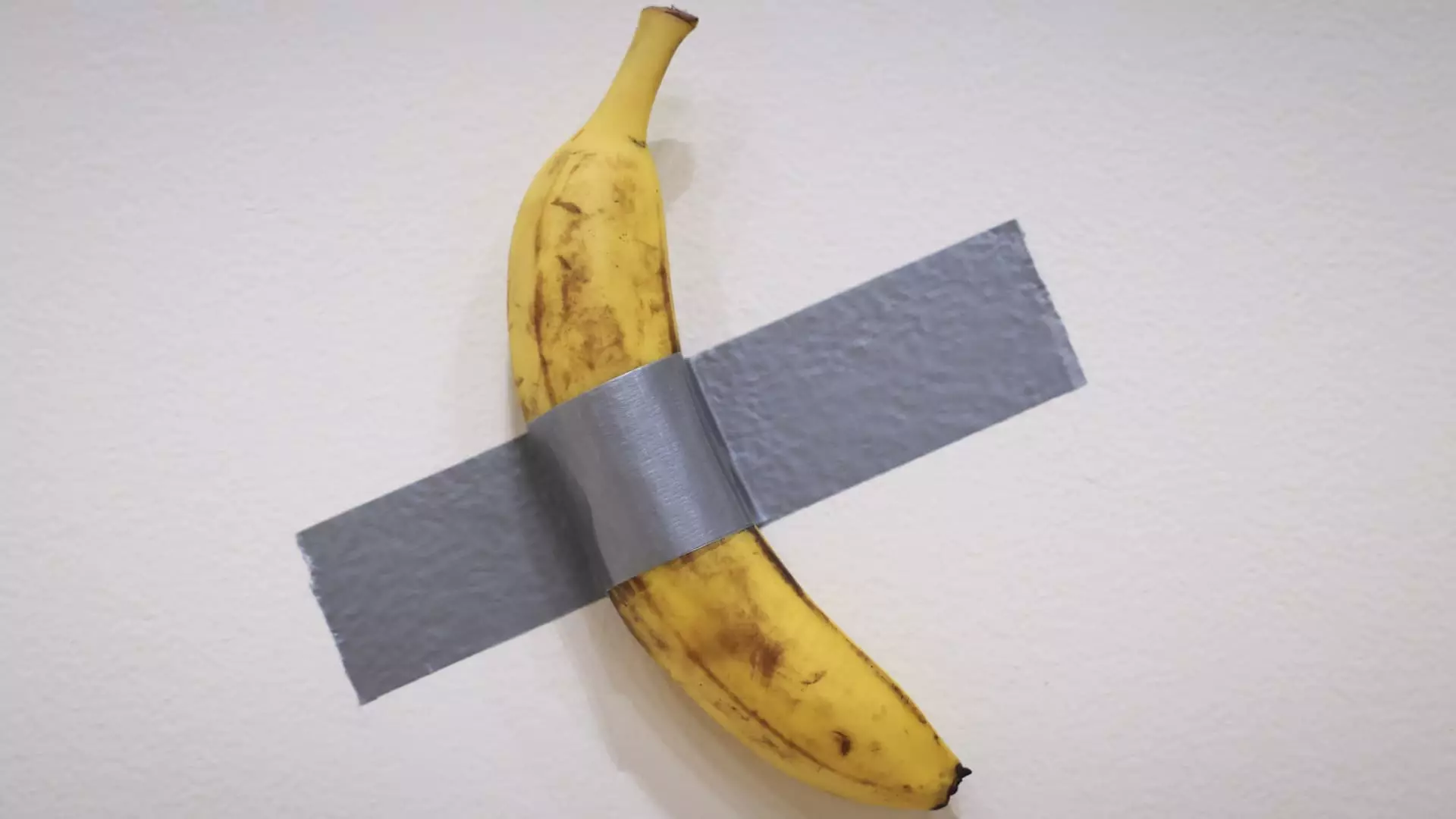

In the contemporary world, where cultural norms are constantly evolving, the intersection of luxury assets, ephemeral art, and digital currencies is gaining attention. The recent sale of a banana duct-taped to a wall for a staggering $6.2 million not only exemplifies this trend but also highlights the shifting definitions of value in the art world. This controversial piece, titled “Comedian” by the Italian artist Maurizio Cattelan, serves as a tangible representation of the blurring boundaries between traditional artworks, memes, and the burgeoning cryptocurrency market.

The auction held by Sotheby’s marked a dramatic event in New York, with a mix of exhilaration and disbelief as bids surged for Cattelan’s unconventional work. Justin Sun, a prominent figure in the cryptocurrency realm, emerged victorious after engaging in rivalry with several bidders, securing the artwork with cryptocurrency funds. Sun’s declaration that this piece is more than mere art but a “cultural phenomenon” underscores the conceptual complexity of contemporary art today. His assertion reflects a mindset where art is no longer confined to physical attributes but extends into the realms of community, identity, and digital ownership.

Sun’s decision to pay for an artwork that will soon require a constant supply of replacement bananas highlights the peculiar valuations placed in modern art, informed increasingly by trending aesthetics rather than traditional artistic merit. “Comedian” first captivated audiences at Art Basel Miami Beach in 2019, initially priced at $120,000. Its viral nature and the associated media frenzy around the art piece surged its perceived worth exponentially. Now, with a price tag in the millions, we are prompted to examine how societal perception can elevate an artwork’s value almost to absurd levels.

The crux of the matter lies in what constitutes value in art today. Unlike classical works that derive worth from their craftsmanship or historical context, the value of “Comedian” comes from its absurdity and the narrative attached to it. Coined by observers as a parody of art itself, this piece invites debate over the authenticity and purpose of art in society. Sun’s acquisition reflects an ever-morphing art market shaped by not just high-net-worth individuals but also by a digital economy that seeks to redefine ownership through the lens of non-fungible tokens (NFTs).

A critical look at the sale reveals a connection between the physical and digital realms. The very notion that ownership is represented by a certificate rather than the banana itself resonates with the NFT phenomenon, where digital ownership equates to a connection to the original creator. This paradigm shift propels art into a new era, challenging conventional definitions while sparking discussions around authenticity and replication.

The timing of this sale, juxtaposed against a backdrop of the art market’s recovery, raises interesting questions. Following two years of downturns, major auction houses like Sotheby’s and Christie’s are experiencing renewed energy, driven in part by wealthy investors buoyed by a recent resurgence in the stock market. Both the rising demand for unorthodox art pieces and the willingness to pay hefty sums signal a significant transformation in collector sentiment, suggesting a renewed belief in the potential for long-term value in art.

Prices at recent auctions have been indicative of a market thirsty for bold, statement works like Cattelan’s. With a Monet water lilies painting fetching a whopping $65.5 million and a surrealist Magritte selling for $121 million, the reopening of wealth channels points to a burgeoning appetite for investment in high-profile names and attention-grabbing conceptual works.

The phenomenon surrounding the banana duct-taped to a wall encapsulates the current zeitgeist of art, culture, and investment, where absurdity mingles with high market value. Justin Sun’s purchase serves as a testament to the new norms governing art ownership—where the line between digital and physical possessions continues to blur, challenging traditional ideas around value and authenticity. As collectors and enthusiasts alike navigate this unpredictable landscape, the art world finds itself at a pivotal crossroads, where the discussions around what makes art valuable are more essential now than ever.