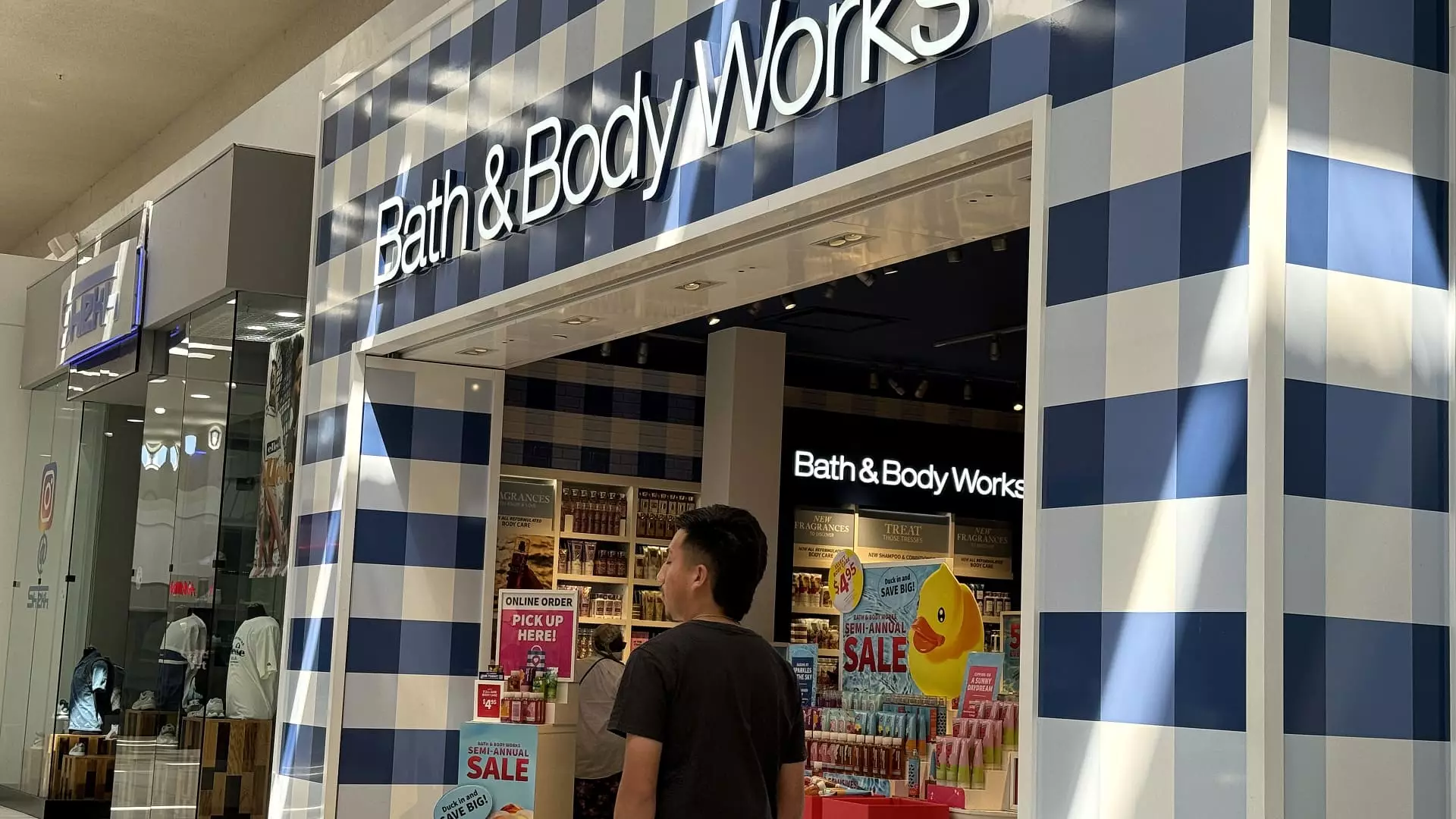

The retail sector has recently witnessed some noteworthy fluctuations, particularly with Bath & Body Works. Following the release of their third-quarter earnings report, shares surged by 16%. The company posted earnings of 49 cents per share, surpassing analysts’ expectations of 47 cents, while generating revenue of $1.61 billion, which outperformed the forecasted $1.58 billion. This positive market reaction showcases the retailer’s continued appeal among investors, suggesting confidence in their growth trajectory amidst an otherwise competitive landscape.

In a similar vein, Robinhood’s stock witnessed an increase of over 7% after Morgan Stanley upgraded its rating from “equal weight” to “overweight.” This pivot suggests a shift in sentiment regarding the brokerage’s future potential, particularly as the investment outlook suggests that post-election trading may see an uptick, enhanced by prospects of crypto deregulation. This upgrade could signify a broader trend where investors are increasingly basing decisions on macroeconomic conditions rather than just firm-specific data, indicating a shifting landscape in the brokerage market.

Macy’s Faces Scrutiny Amid Accounting Concerns

Conversely, Macy’s is navigating turmoil after announcing it would delay its third-quarter results due to the discovery of significant accounting discrepancies. An employee’s fraudulent adjustments to delivery expenses masked inaccuracies that spanned multiple years, affecting figures between $132 million and $154 million. While Macy’s maintains that these errors do not compromise its cash position, the potential reputational damage may weigh heavily on investor perception. This scenario emphasizes the critical importance of governance and integrity in financial reporting, as lapses can lead to substantial repercussions, often undermining investor confidence.

Investors have increasingly turned their attention to Abercrombie & Fitch, with shares climbing 3% in anticipation of its upcoming earnings announcement. Analysts predict the retailer will report earnings of $2.39 per share and revenue of $1.19 billion, driven largely by robust sales from its Abercrombie and Hollister brands. The company’s optimistic outlook follows a positive performance from competitors, which have set a constructive tone heading into the busy holiday season. This highlights a broader trend in the retail clothing sector where consumer sentiment may be picking up.

Target has also caught the eye of investors with a nearly 2% stock price increase after Oppenheimer designated it as a top pick. Despite a year-to-date decline of approximately 12%, its attractive dividend yield combined with a favorable risk-to-reward evaluation suggests a potentially lucrative investment for those looking for stability amid market volatility. This signals a cautious optimism among consumers, as they navigate possible economic uncertainties.

Technology and Beauty Stocks Show Signs of Growth

MicroStrategy’s impressive increase of 3% was bolstered by Bernstein’s strategic adjustment of its price target, reflecting a remarkable 568% surge in shares this year. Additionally, Sally Beauty Holdings experienced a 3% jump due to an upgrade from hold to buy by TD Cowen, emphasizing the company’s robust free cash flow. Santander also saw gains of 2% following a similar upgrade, suggesting a positive outlook tied to its capital generation capabilities. These movements illustrate that within a diversified market, technology and consumer goods sectors are still capturing investor interest, signaling a potential turnaround.

As we assess these movements, it’s evident that amidst challenges, certain companies are managing to capitalize on investor sentiment and market conditions, reflecting the dynamic nature of financial markets.