The annual gathering of Berkshire Hathaway shareholders is not merely a financial review; it acts as a rendezvous point for investment enthusiasts and admirers of Warren Buffett, the company’s esteemed CEO. This year, as anticipation built for the meeting, a distinct sentiment emerged—one that belongs not only to the world of business but equally to the realm of altruism. The culminating auction for signed memorabilia was driven by something deeper than mere monetization of nostalgia. Alan Knauf, CEO of the Stephen Center, was not alone in expressing astonishment at the sheer magnitude of generosity exhibited by Buffett and participants alike, raising a staggering $1.3 million for charitable causes. Traditionalists may deem such focus on philanthropy as a departure from the primordial capitalist spirit, yet it steadfastly illustrates how corporate giants can leverage their influence for immense social good.

In an era marked by relentless consumerism and profit-driven motives, Buffett has chosen a path that reveals the true essence of wealth—an instrument for improving the lives of others. His actions invigorate a dialogue about the responsibility that accompanies financial success, suggesting that benevolence can be woven seamlessly into the fabric of business.

The Auction: Where Wealth Meets Warmth

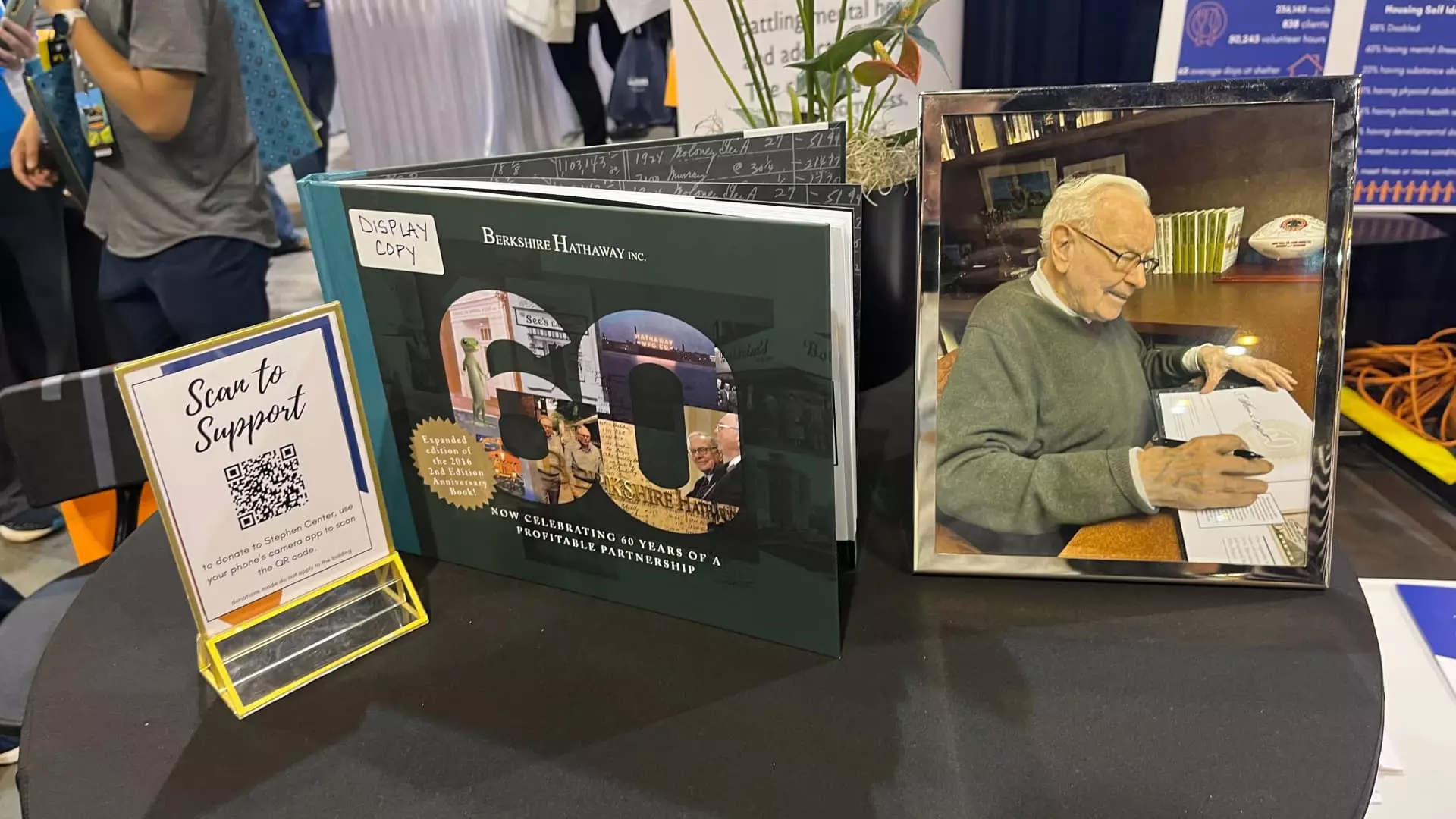

The spectacle surrounding the auction—replete with wire transfers originating from as far as Singapore—captured the imagination of participants. This wasn’t merely an exchange of goods; it was a moment that blurred boundaries between privilege and purpose. In reserving signed copies of “60 Years of Berkshire Hathaway” to raise funds for the Stephen Center, Buffett provided not just a collector’s item but an opportunity for investors to amalgamate their admiration for him with actionable kindness. Armed with dollars that represent years of hard work, bidders like Matthew Rodriguez acknowledged their stake in the process, contributing hefty sums for what they saw as priceless artifacts with a philanthropic lineage.

Moreover, this event underscores a crucial theme in today’s financial climate: an emerging expectation that the wealthy—including mega-investors—should cultivate a relationship with the community. Rodriquez’s opening up about his intention to support a local charity reflects a growing consciousness among investors; wealth does not exist in a vacuum, and it is, therefore, paramount for its bearers to extend their reach beyond personal gain.

Buffett’s Lasting Legacy: The Social Responsibility of Wealth

As Buffet announced his intention to step down as Berkshire’s CEO, this year’s auction attained extra significance, becoming emblematic of both an ending and a new chapter. The metamorphosis of a revered investment career into an enduring legacy of charitable engagement raises questions for the next generation of business leaders. What will their responsibilities be, and how will they carry the torch?

Buffett has long advocated for the dissolution of wealth dynasties, seeking instead to position philanthropy as a driving force for social change. He is not merely an advocate of the age-old adage “to those who much is given, much is expected” but rather a practitioner of it. Critically, his method of galvanizing his shareholders toward collective benevolence blends the personal with the communal, propelling a narrative that calls for action. This has particular resonance today, as more Americans grapple with economic disparities that disproportionately affect marginalized communities.

Data revealing nearly a 10% increase in homelessness in Omaha adds urgency to Buffett’s charity efforts. Calls to action, such as those articulated by Stephen Center CEO Alan Knauf, ignite a collective social conscience that begs the question—how can we, as members of a capitalist society, redefine success beyond financial metrics?

A Community’s Response: The Philanthropic Ripple Effect

Inspired by the spirit of philanthropy that permeated the event, many shareholders—some unable to bid on the signed books—donated directly to the Stephen Center. Some expressed gratitude toward Buffett, revealing another layer to the philosophy of philanthropy; support can stem from simple gratitude, magnifying the impact of one’s actions within their local community. The story of Jay Ji, whose family faced economic hurdles in the past, further illustrates how personal history often influences one’s approach to social responsibility. Ji’s determination to ease hardships for others mirrors a broader quest for equity that resonates with countless individuals.

As funds flow to improve the Stephen Center’s services, a narrative emerges that advocates for the homeless as part of the social fabric. In highlighting the mission of shelters and recovery programs, Buffett’s initiative invites reflection on neglected societal issues that remain in shadows as the focus on wealth creation dominates discussions.

Therefore, when next we consider the relationship between wealth and duty in our society, it may not only be about imitating the present but understanding its evolutionary potential. By taking lessons from Buffett’s actions, we open the door to a new wave of socially responsible capitalism—where the wealth accumulated translates directly to meaningful community impact, reinforcing the belief that philanthropy can indeed serve as a worthy counterbalance to the relentless pursuit of personal profit.