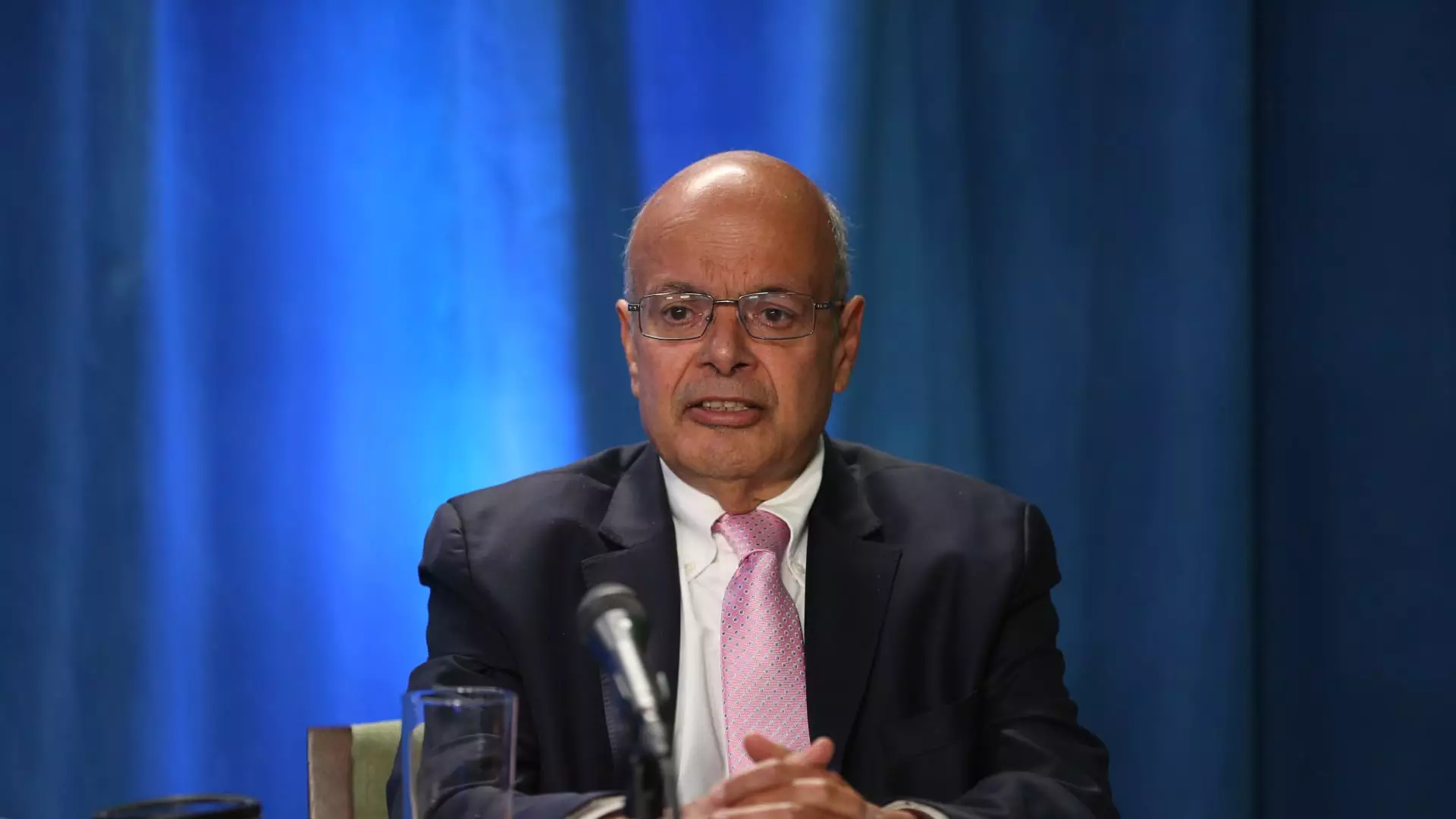

In an unexpected turn within the upper echelons of Berkshire Hathaway, Ajit Jain, long regarded as a pivotal figure in the organization, sold a substantial portion of his shares this week. This decision, reflected in a recent regulatory filing, indicates that Jain let go of more than half of his holdings in Berkshire Hathaway, specifically 200 shares of the prestigious Class A stock, at an average price of approximately $695,418 each. The total transaction amounts to around $139 million, a figure that raises eyebrows given Jain’s deep ties to the company and its operations heading into the future.

As a result of this sale, Jain retains a mere 61 Class A shares personally, while family trusts set up for his descendants maintain 55 shares, and his nonprofit organization, the Jain Foundation, possesses an additional 50 shares. This sale, marking a 55% reduction in his total stake, represents the most significant withdrawal since he joined Berkshire Hathaway in 1986. Such a dramatic shift prompts one to question the motivations and implications of this move within the context of the larger corporate landscape.

The timing of Jain’s sale coincides with an impressive ascension in Berkshire’s stock prices, which soared above the $700,000 mark recently, prompting a newfound market capitalization of $1 trillion. This surge in valuation seemed to provide Jain with an opportune moment to capitalize on his shares. However, the implications of such a sale frequently extend beyond mere financial strategy.

David Kass, a finance professor at the University of Maryland, suggests that this action could signify Jain’s perception of Berkshire Hathaway as fully valued at present market levels. This perspective aligns with recent patterns of reduced share repurchase activities by the corporation. In a notable contrast to the previous quarters, where Berkshire repurchased stocks valued at around $2 billion, the second quarter saw a mere $345 million allocated to stock buybacks. This sharp decline further indicates possibly that Berkshire’s management is reevaluating its approach to capital deployment amidst changing market conditions.

Furthermore, Bill Stone, Chief Investment Officer at Glenview Trust Co., points to the current valuation metrics, suggesting that with Berkshire trading at a price of over 1.6 times book value, the stock is nearing Buffett’s conservative intrinsic value estimate. From this vantage point, Jain’s decision could be interpreted as an acknowledgment that the stock may not be a bargain and could postpone lucrative repurchase programs.

Ajit Jain’s tenure at Berkshire Hathaway has been nothing short of remarkable. His strategic insights have facilitated expansive growth, particularly in the reinsurance sector, where he has relentlessly driven profitability. More recently, his leadership has played a significant role in revitalizing Geico, an essential segment of Berkshire’s diverse portfolio. Recognizing Jain’s contributions, Warren Buffett himself once expressed: “Ajit has created tens of billions of value for Berkshire shareholders,” positioning Jain as a cornerstone of Berkshire’s operational success.

While succession speculation has swirled around the leadership of Berkshire, with Jain frequently mentioned as a potential successor to Buffett, it is evident from Buffett’s statements that Jain has never pursued that path. Recently, Buffett reassured stakeholders by clarifying that there was no rivalry between Jain and Greg Abel, the vice chairman of non-insurance operations designated to take over leadership upon Buffett’s eventual retirement.

Ajit Jain’s decision to divest a significant portion of his stock in Berkshire Hathaway not only sheds light on his personal financial acumen but also reflects broader market trends and potential shifts in investment philosophy within the company. As Berkshire Hathaway navigates the complexities of valuation and returns in a radically changing investment landscape, Jain’s actions serve as a reminder that strategic decision-making is often multidimensional, influenced by market sentiment, intrinsic value, and individual foresight.

As stakeholders analyze these developments, the implications of Jain’s move will likely resonate through the fabric of Berkshire Hathaway, prompting discussions on value assessment, leadership succession, and strategic focus in the navigating economic future ahead. The decisions made today will undoubtedly set the stage for the venerated company’s next chapters, with Ajit Jain’s legacy firmly at the forefront of its narrative.