The Consumer Financial Protection Bureau (CFPB) has long played a crucial role in safeguarding consumer rights in the financial sector, particularly in the aftermath of the 2008 financial crisis. Established to ensure that banks and financial institutions adhere to fair practices, the CFPB focuses on preventing consumer exploitation. However, recent developments have cast a shadow over its future, leading to intense scrutiny and uncertainty among its approximately 1,700 employees.

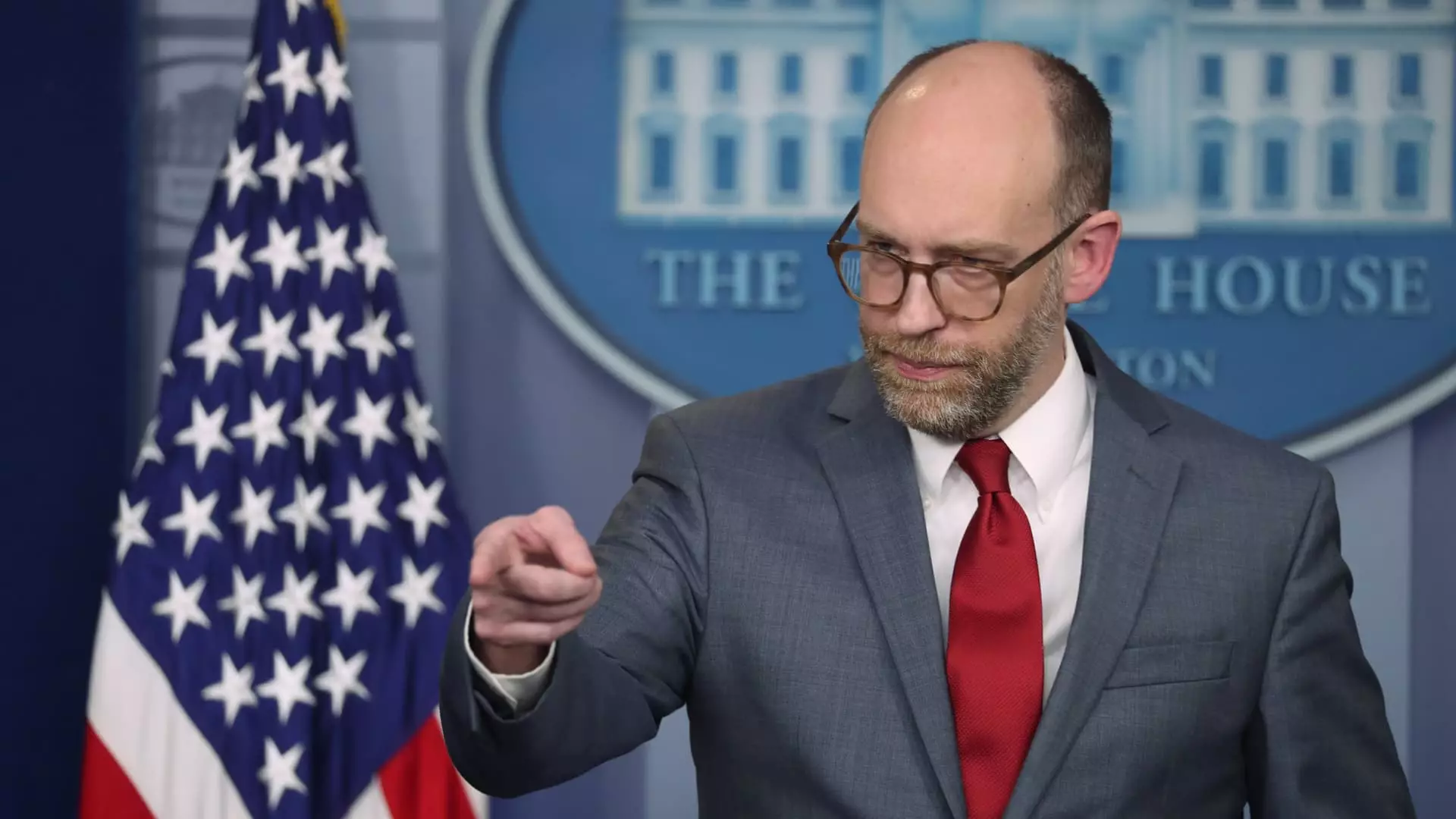

Amidst political turbulence, a memo from Adam Martinez, the COO of the CFPB, indicated that staff would be required to work remotely until February 14, 2024. This announcement came on the heels of a directive from acting director Russell Vought, which effectively paused most agency operations, including the supervision of financial firms. Such drastic measures have elicited significant concern regarding the agency’s functional capacity and the implications for consumer protection.

The current turmoil surrounding the CFPB reflects a broader political strategy that aims to reshape the federal regulatory landscape. Russell Vought, who recently took the reins at CFPB, is known for his association with Project 2025—a plan intended to restructure various government agencies significantly. His initial actions, including freezing funding and halting activities, signal a philosophical shift that questions the necessity of the CFPB’s existence.

Adding to the uncertainty is the involvement of operatives linked to Elon Musk’s DOGE initiative. Reports suggest these individuals have gained unprecedented access to CFPB data sources—including sensitive internal evaluations—which raises alarms about oversight and potential misuse of information. Musk himself has openly expressed disdain for the CFPB, exemplified by his recent social media post proclaiming “CFPB RIP.” Such high-profile scrutiny from influential figures like Musk inevitably fuels speculation about the agency’s sustainability.

The freeze on CFPB operations has left employees grappling with anxiety over job security and possible administrative leave or termination. As similar strategies have been employed against other federal agencies in the past, employees within the CFPB are understandably concerned about their futures. With only a fraction of CFPB roles being legally mandated, large-scale layoffs could radically undermine the bureau’s mission.

If allowed to proceed unchecked, these measures could stall crucial initiatives aimed at enhancing consumer protections. Efforts such as the proposed restrictions on exorbitant credit card fees and the removal of $49 billion in medical debt from the credit reports of millions of Americans hang in jeopardy. These initiatives have the potential to benefit countless consumers and prevent financial hardship for vulnerable populations.

Reactions from Stakeholders and Implications for Consumer Finance

Meanwhile, financial industry stakeholders have been vocal about the agency’s perceived overreach, often framing the CFPB as an adversary rather than a protector of consumer rights. Bank trade groups have historically challenged the bureau’s regulations, seeking to undermine its authority in court and question its constitutional legitimacy. As the CFPB faces existential threats from within the government, the concerted efforts of these groups could gain momentum, further jeopardizing consumer protections.

Going forward, the future of the CFPB appears increasingly precarious. As it contends with both internal upheaval and external pressures, the ramifications extend beyond the agency itself, affecting consumers who rely on its oversight to navigate the financial landscape. The chilling effect on regulatory measures may serve to embolden financial firms looking to exploit gaps in oversight, ultimately disadvantaging millions of everyday Americans who depend on the bureau’s protective presence.

The challenges facing the Consumer Financial Protection Bureau encapsulate a broader struggle over the direction of federal regulation in the financial sector. With political motivations steering operations and employee morale wavering, the agency’s ability to champion consumer rights hangs in the balance. As developments continue to unfold, stakeholders from various sectors will vigilantly monitor the outcomes, knowing that the implications for consumer protection could be profound and lasting. The CFPB is undoubtedly at a critical juncture, and its future will ultimately shape the financial environment for people across the nation.