Super Micro Computer Inc., a prominent player in the server manufacturing industry, is currently embroiled in a significant compliance struggle that has attracted the attention of investors and regulators alike. Recently, the company appointed BDO as its new auditor, signaling an attempt to rectify its financial reporting issues and regain traction on the Nasdaq exchange. As the circumstances surrounding Super Micro illustrate, compliance is not just a regulatory obligation; it’s a fundamental aspect of corporate governance that can profoundly impact a company’s reputation and financial stability.

The timing of Super Micro’s transition from Ernst & Young to BDO cannot be overlooked. Ernst & Young’s sudden departure in October raised eyebrows in the financial community, especially considering the firm had only taken over the auditing responsibilities from Deloitte & Touche earlier in March. This carousel of auditors can often create an air of uncertainty for stakeholders who rely on these expertise to gauge a company’s financial health. When a company changes auditors frequently, it prompts questions about internal controls, the integrity of financial reporting, and the overall governance practices of the organization.

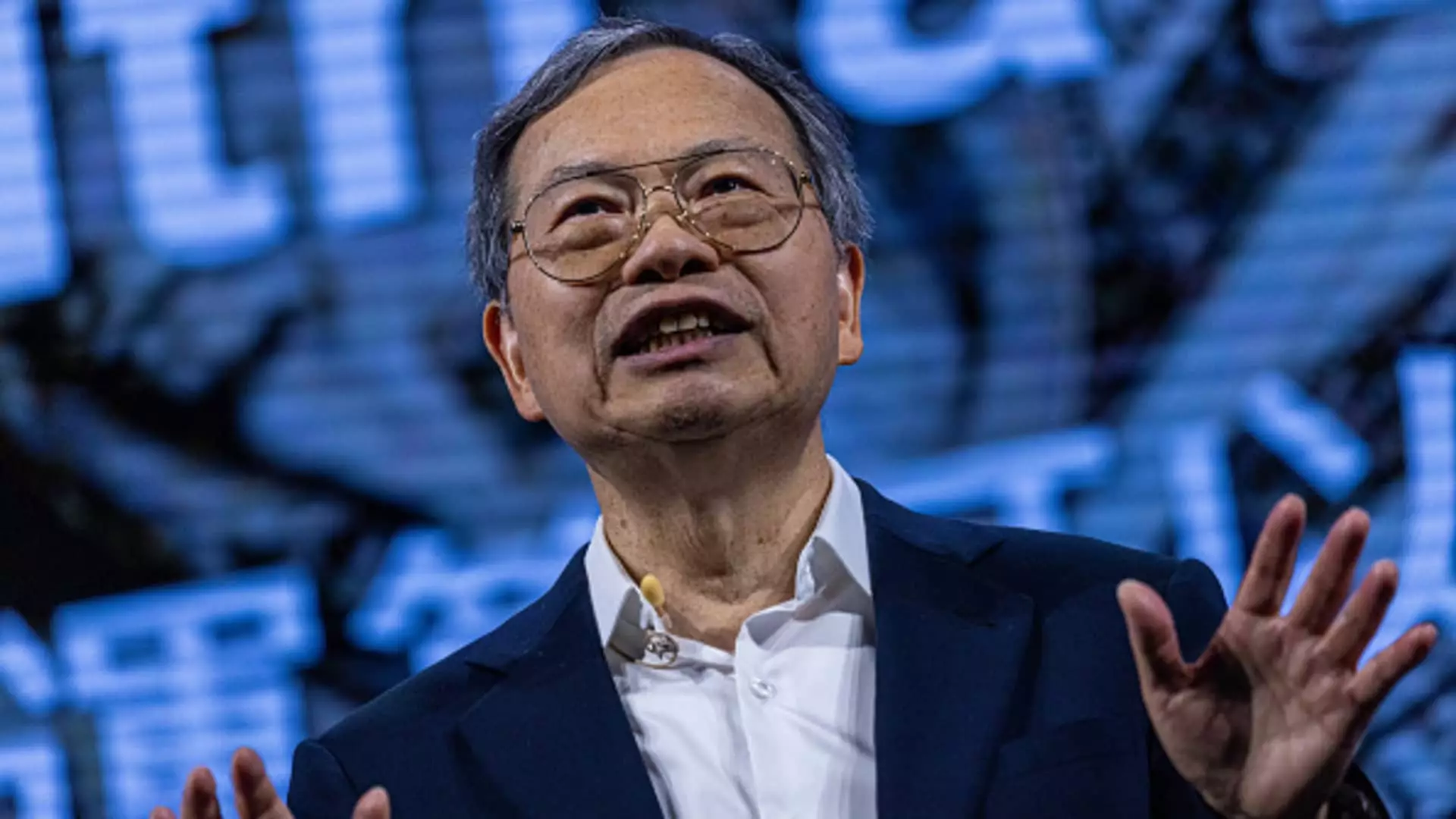

Super Micro’s CEO, Charles Liang, acknowledged the urgency of the situation in a public statement, asserting that the company is diligently working to bring its financial statements up to date. With the 2024 year-end report overdue, the pressure is on not just to comply with the Securities and Exchange Commission (SEC) requirements but also to reassure investors that the company is on the right track. This potential shift could bolster investor confidence if managed effectively, but it carries risks that must be navigated carefully.

The immediate stock market reaction to Super Micro’s recent announcements was telling. Shares surged by 23% in after-hours trading, exemplifying the market’s propensity for optimism when it senses a turnabout in corporate fortunes. However, this rebound comes amidst a backdrop of volatility—Super Micro’s stock experienced meteoric rise prior to hitting a nadir due to compliance-related issues. From a market cap of approximately $70 billion at its peak, the company saw its value plummet to $12.6 billion by the close of trading on Monday, a stark reminder of how swiftly fortunes can change in the corporate world.

The stock’s significant fluctuations also highlight the dual nature of market behavior—while traders often react promptly to encouraging news, underlying issues pertaining to compliance can have lingering effects. Super Micro’s prior association with the artificial intelligence boom, driven by its partnership with Nvidia, suggests that while the company has operational strengths, its governance failures can overshadow otherwise positive developments.

Super Micro’s future hinges on its ability to align its operations with regulatory expectations and restore investor trust. The filing of both its annual and quarterly reports will prove crucial in this regard. Moreover, the company must also contend with allegations of accounting manipulation, as pointed out by short-seller Hindenburg Research. This scrutiny adds another layer of complexity to its recovery strategy and underscores the importance of transparent financial practices.

The company’s recent advancements, including the launch of products utilizing Nvidia’s next-generation AI chip, Blackwell, indicate a strong product lineup that could lead to lucrative opportunities. By aligning its innovative capacity with strategic compliance efforts, Super Micro has the potential not only to recover its standing on Nasdaq but also to emerge as a stronger entity in the tech sector.

Super Micro Computer’s present challenges encapsulate the critical nature of compliance in maintaining corporate credibility and investor confidence. While the appointment of BDO may signify a shift towards accountability, the overarching narrative remains one of vigilance and proactive governance as the firm navigates a complex landscape fraught with scrutiny and market dynamics. The path to recovery will require meticulous planning and execution, reinforcing the notion that sound compliance is as vital as strategic growth in the journey of any publicly traded company.