In an increasingly digital world, the responsibility of tech giants like Meta, the parent company of Facebook, to protect users from scams has come under scrutiny. Recently, British fintech firm Revolut expressed its dissatisfaction with Meta’s actions concerning online fraud. Revolut’s criticism arose after Meta announced a collaboration with U.K. banks NatWest and Metro Bank aimed at improving data sharing to prevent financial crime. However, Revolut argues that this initiative falls significantly short, emphasizing that major tech companies must take more substantial steps to protect their users from fraud.

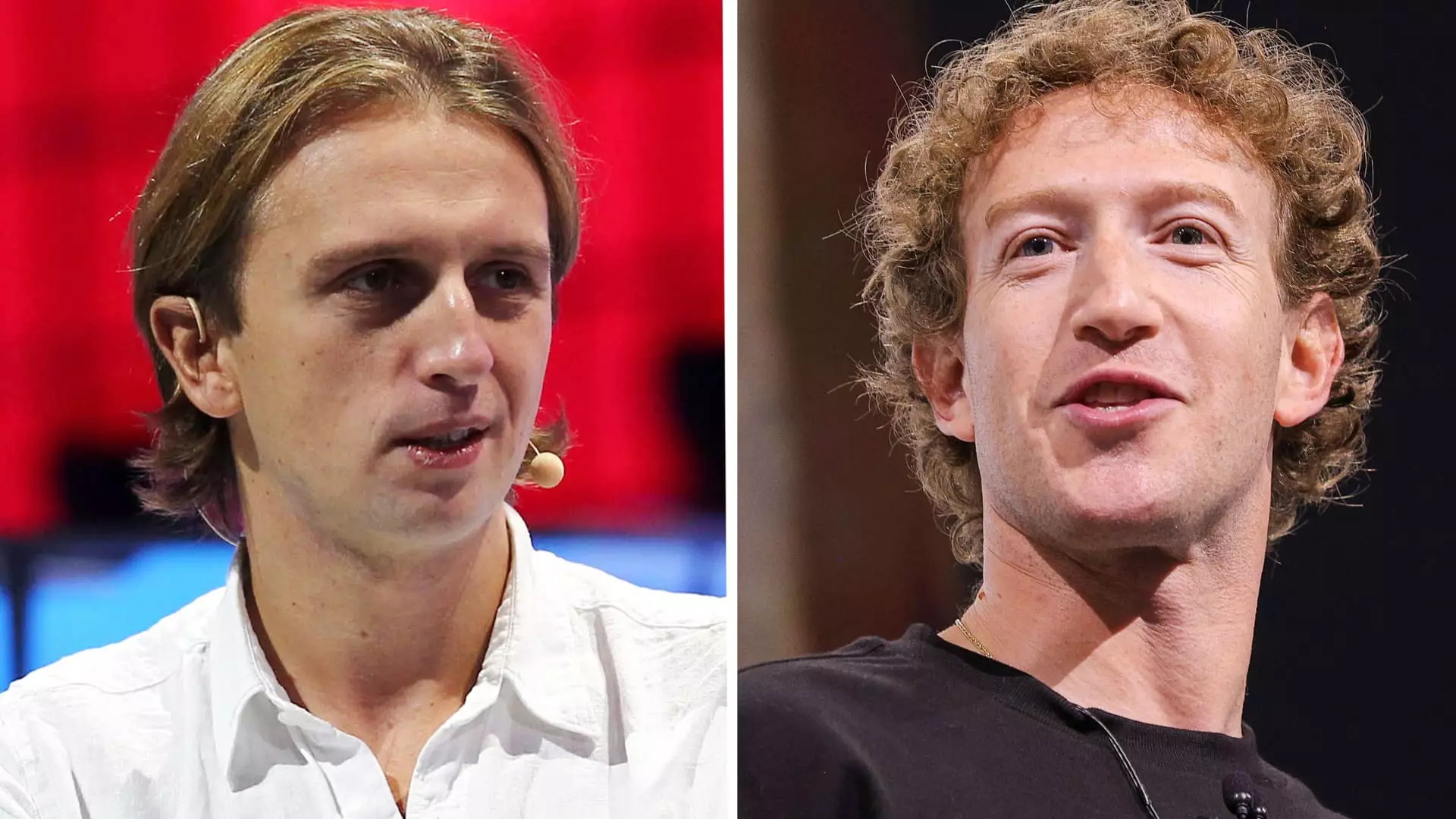

Woody Malouf, the head of financial crime at Revolut, articulated his organization’s stance, labeling Meta’s approach as merely “baby steps.” He stressed the necessity for “giant leaps forward” in terms of action against fraud. This sentiment reflects a broader frustration within the fintech industry regarding the lack of accountability among social media platforms in reimbursing victims of fraud. Malouf pointed out a crucial issue: without financial repercussions, platforms have little motivation to enhance their safety measures. The partnership with banks, while potentially useful, does not address the core problem of accountability for fraud outcomes.

Compounding these challenges, new regulations set to take effect in the U.K. are aimed at improving compensation for victims of authorized push payment (APP) fraud, a type of scam where individuals are misled into authorizing a payment. While these regulations will require banks and payment processors to compensate victims up to £85,000 ($111,000), this amount was originally proposed to be higher. Revolut’s Malouf noted that the Payments System Regulator’s decision to scale back the proposed compensation reflects pushback from financial institutions, highlighting the complex dynamics at play in the battle against fraud.

Revolut’s argument demands a reconsideration of how social media platforms like Meta view their role in fraud prevention. The digital ecosystem thrives on user engagement, but this engagement also opens the door to increased vulnerability to scams. As fraud tactics evolve, the onus should not only fall on banks and payment processors but also on the platforms where the scams proliferate. Malouf suggests that without direct compensation for victims, as well as a commitment to implementing effective safety measures, tech companies remain complacent in the fight against fraud.

The discussion initiated by Revolut points toward a pressing need for reform within the digital finance landscape, with significant implications for users worldwide. As the online environment continues to develop, the expectation for comprehensive protective measures becomes more crucial. Social media companies must acknowledge their role in safeguarding users to ensure that they contribute meaningfully to combatting financial fraud. A reevaluation of responsibilities—where platforms are held accountable not just for data sharing but for the consequences of online fraud—can pave the way for a safer digital financial ecosystem.