Contemporary Amperex Technology (CATL), the titan behind many of the world’s most advanced electric vehicle batteries, is poised for much more than just supplying battery packs. While its core business remains hardware manufacturing, recent strategic insights from Morgan Stanley suggest that CATL’s trajectory is steering sharply towards developing an integrated software ecosystem that could redefine its market dominance. This shift is not merely an evolution but a potential revolution in how energy and mobility providers operate.

This move indicates a profound understanding within CATL’s leadership: in the age of digital transformation, hardware alone no longer guarantees sustained growth or competitive advantage. Instead, creating an interconnected platform that monitors, maintains, and enhances battery performance through artificial intelligence (AI) will likely become a critical differentiator. It’s a bet on software as the future of energy sustainability and safety—an area where CATL aims to outpace rivals by offering comprehensive, value-adding solutions that extend beyond mere hardware.

The possible implications are staggeringly broad. An AI-driven monitoring system, capable of providing real-time safety alerts, predictive maintenance, and performance optimization, could significantly enhance trust in electric powertrains. This, in turn, would strengthen CATL’s relationships with automotive manufacturers and energy providers, making the Chinese battery giant a central figure in the eco-system of clean energy—a position that may far exceed its current manufacturing-centric reputation.

Market Optimism Meets Geopolitical Complexities

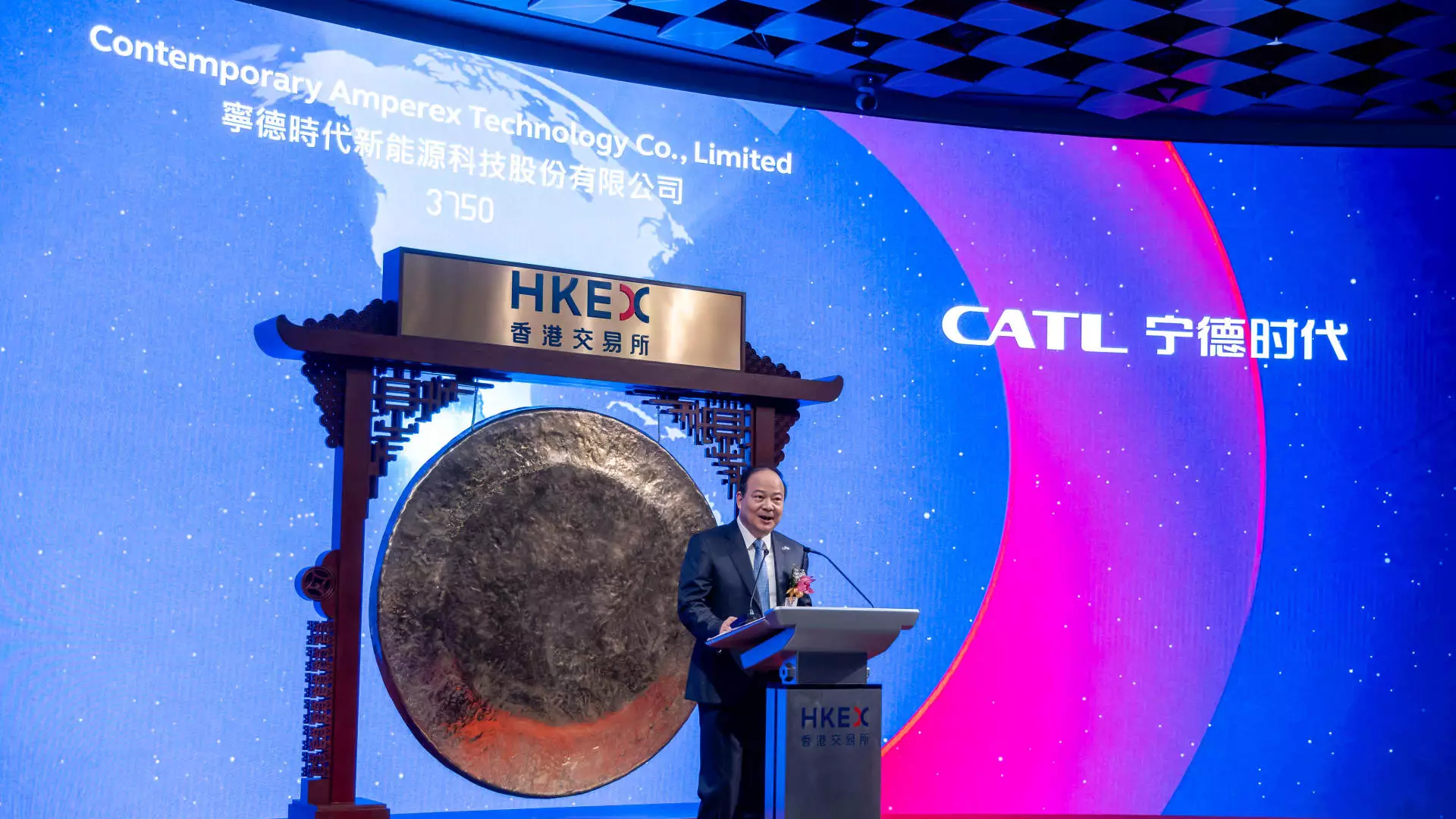

Recent market movements reflect this renewed confidence. Morgan Stanley’s upward revision of CATL’s share price target to HKD 445—roughly $56.69—signifies not just a bullish outlook but a recognition of CATL’s strategic value. The shares hit new heights since their HK debut in May 2025, bolstered by expectations that the company’s innovative approach will reap substantial rewards.

Despite this, the geopolitical landscape complicates matters. CATL’s inclusion on the Pentagon’s “Chinese military” list has cast a shadow over its US prospects, disrupting its expansion in the world’s largest consumer market. The company vehemently disputes the military association, asserting it operates solely within commercial spheres. Nevertheless, the risks associated with such designations cannot be overlooked, especially with the looming possibility of limitations on US government purchases from 2026 onward.

Yet, within this geopolitical tension lies an intriguing strategic response. CATL is channeling its efforts into expanding in Europe, especially with the Hungarian factory nearing completion, and pursuing projects in resource-rich regions like Indonesia. These moves can be interpreted as efforts to diversify beyond US-centric markets, positioning the company as a global energy infrastructure leader. This is a pragmatic response, recognizing that geopolitical adversities may be transient while its core technological and market advantages are enduring.

Strengthening Foundations Through Strategic Alliances and Licensing

Another key element of CATL’s evolving blueprint is its approach to licensing and partnerships. The company’s licensing agreement with Ford, enabling the US automaker to produce lithium iron phosphate (LFP) batteries in Michigan, exemplifies a strategic pivot. Such arrangements allow CATL to expand its technological reach rapidly without heavy capital investment, generating recurring licensing fees that can reach into hundreds of millions annually.

Though some market skeptics caution that profits from licensing might take years to materialize fully, the overarching narrative remains optimistic. This strategy bypasses trade barriers and regulatory scrutiny while still capturing value from its technological advancements. Additionally, a close watch on industry partnerships, such as Xiaomi’s adoption of CATL batteries for its SUV models, indicates a broader push to secure market share across diverse segments.

These collaborations suggest that CATL’s vision is not confined to traditional battery manufacturing but extends into shaping the future landscape of hybrid and electric mobility through innovative technologies like battery swapping and hybrid systems. The Zeekr hybrid SUV, powered by CATL’s “Freevoy Super Hybrid Battery,” exemplifies an expansion into hybrid technology, blending electric and conventional power sources to meet evolving consumer preferences for versatility and range.

Financial Fortresses and the Power of Scale

Underlying these strategic shifts is CAMTL’s formidable financial and technological scale—an industrial behemoth capable of achieving cost efficiencies that smaller competitors simply cannot match. Analysts from Bank of America see CATL’s strengths—not just in its technological leadership but also in its broad-access scale—as key to its potential for sustained profit margins.

Their excitement about CATL’s prospects hinges on its ability to leverage economies of scale while safeguarding its technological edge. The company’s investments in nickel and battery recycling projects in Indonesia and expansion into European markets further bolster its capacity to control raw material costs and enhance sustainability credentials—factors increasingly valued by global consumers and regulators alike.

While some skeptics might argue that expanding too rapidly or diversifying into multiple markets could dilute focus, CATL’s strategic management seems aligned with the broader trend: harnessing technological innovation, geopolitical agility, and financial strength to carve out a dominant position in the emerging clean energy economy. This approach reflects a pragmatic center-right perspective, recognizing that market leadership, technological mastery, and geopolitical resilience form the trifecta necessary for long-term success in an increasingly uncertain world.