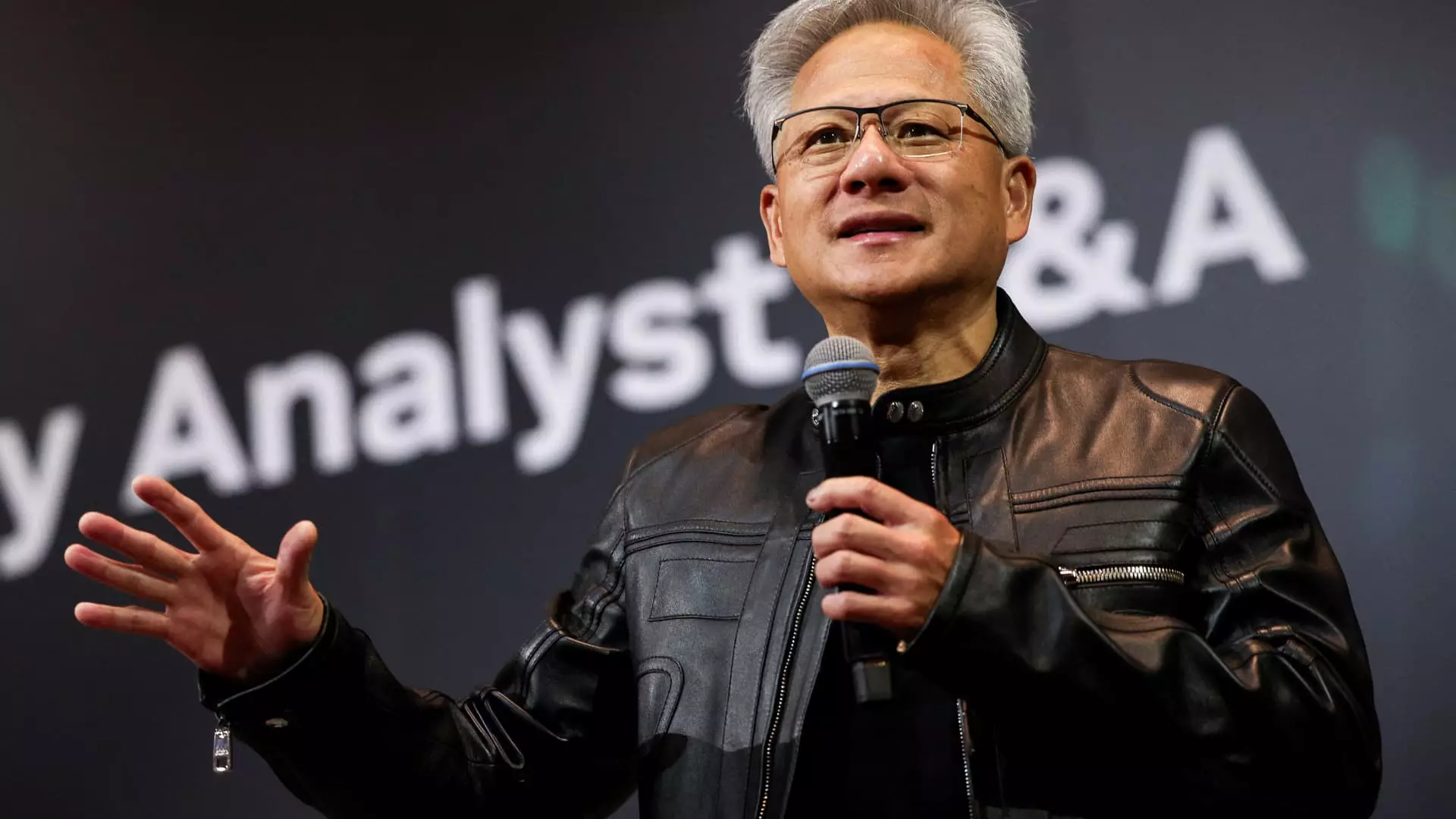

In recent weeks, the technology sector has been rife with shifting allegiances and strategic positioning, with Nvidia’s CEO Jensen Huang publicly lauding Taiwan Semiconductor Manufacturing Co. (TSMC) amidst mounting geopolitical and economic tensions. His remarks, describing TSMC as “one of the greatest companies in human history,” seem to convey admiration on the surface. However, beneath the surface, they serve a more calculated purpose: signaling to both the market and government actors that TSMC remains an indispensable pillar of global supply chains. This softer tone toward Taiwan’s semiconductor giant is also an implicit endorsement of its strategic importance, especially as Washington considers wielding influence through stakes in key chipmakers.

Huang’s comments aren’t made in isolation—they are part of a broader narrative that reinforces TSMC’s dominance and the critical role it plays in Nvidia’s AI ambitions. With U.S. policymakers eyeballing stakes in firms like TSMC under the CHIPS Act, Nvidia’s praise arguably functions as a subtle nod to the fragility and strategic centrality of Taiwan’s manufacturing prowess. By elevating TSMC’s stature, Nvidia inadvertently casts a spotlight on the geopolitical gray zone that defines current global semiconductor politics—neither fully aligned with China nor entirely under U.S. influence, but vital to both.

Pandering to Geopolitical Realities or Power Politics?

The Biden administration’s push to encourage domestic chip production via the CHIPS Act has ignited a complex web of incentives and strategic considerations. While the legislation ostensibly seeks to bolster American technological independence, it also opens a Pandora’s box of political maneuvers involving investments and potential stakes in foreign companies, especially those based in Taiwan and South Korea. The U.S. government’s contemplation of acquiring up to a 10% stake in TSMC exemplifies this maneuvering—an attempt to wield influence without overtly taking control.

This balancing act raises doubts about America’s genuine commitment to robust domestic manufacturing. Instead, it appears to magnify the geopolitical tension, with the U.S. attempting to leverage economic investments to secure a foothold in the global supply chain. Huang’s praise of TSMC is not merely a compliment; it’s a strategic signal, subtly aligning Nvidia’s interests with those of Taiwan’s chip industry—interests that are now entangled with Washington’s geopolitical ambitions. For a center-right conservative regime that values strategic independence and national sovereignty, such an alliance doesn’t come without risks: they risk entanglement in a dangerous game of influence over a region fraught with instability.

Supply Chain Dependencies and the Illusion of Control

Nvidia’s expansion efforts in Taiwan further illustrate the complex dependency on Taiwanese manufacturing capabilities. The company’s plans for a new Taiwan office and its reliance on local suppliers underscore its strategic prioritization of Taiwan as a hub for innovation and production. Yet, this dependence also exposes vulnerabilities—particularly as geopolitical tensions with China rise. Nvidia’s own response to Beijing’s security concerns regarding its H20 chips reveals the delicate dance of technological diplomacy, where commercial interests are intertwined with national security considerations.

The recent pause on shipments to Chinese firms, including major players like Foxconn, underscores the fragility of reliance on Taiwan’s manufacturing ecosystem. It exposes how geopolitical disputes can swiftly disrupt supply chains, forcing companies like Nvidia to navigate a minefield of diplomatic sensitivities. For center-right policies, which often emphasize pragmatic resilience over ideological rigidity, this complex web of dependencies demands careful re-evaluation: Should foreign policy be shaped more by strategic self-sufficiency, or by the pragmatic acknowledgment of interdependence?

Are We Witnessing a Shift Toward Strategic Subservience?

Huang’s remarks and Nvidia’s expansion in Taiwan serve as a clear indication that the global semiconductor industry is increasingly beholden to regional power dynamics. While the U.S. pushes for independence through legislation and incentives, the actual operational backbone remains intertwined with Taiwanese and East Asian manufacturers. The narrative of technological sovereignty often rings hollow when the supply chains and manufacturing hubs are concentrated in a geopolitically volatile region.

This raises profound questions about Western’s ability to truly assert control over its technological future. Instead of fostering genuine independence, there is an undeniable risk of entering into a form of strategic subservience—where alliances, investments, and diplomatic gestures are aimed more at preserving existing advantages than at building sustainable, autonomous industries. For those of us who lean center-right, advocating for a pragmatic balance between free-market dynamism and strategic sovereignty, the current path risks creating a dependency trap masked as sovereign resilience.

The Illusory Promise of Self-Reliance

The rhetorics of technological independence are increasingly challenged by the realities of global supply chains. Nvidia’s emphasis on Taiwan’s manufacturing prowess and the U.S. government’s interest in acquiring stakes are symptomatic of a broader narrative: the illusion that state-led interventions and strategic investments can insulate a nation from geopolitical risks. In practice, the semiconductor industry’s intricate web of international cooperation makes complete self-reliance a mirage.

Ironically, efforts to “bring back” manufacturing to the U.S., such as the expansion of TSMC’s facilities in Arizona, symbolize both an ambition for sovereignty and an acknowledgment of dependence on foreign experts and infrastructure. The greater risk for policymakers committed to a center-right economic philosophy is accepting the false premise that mere investment and rhetoric will secure technological dominance. Instead, a more sober approach recognizes that genuine resilience must be coupled with diversified supply chains, technological innovation, and pragmatic geopolitical strategy, rather than symbolic gestures that mask vulnerabilities.

Note: The critical tone applied here emphasizes skepticism about the rhetoric of independence and the geopolitical implications of current semiconductor strategies. The article advocates for pragmatism over idealism and urges a balance that prioritizes national interests without falling into dependency or overreach.