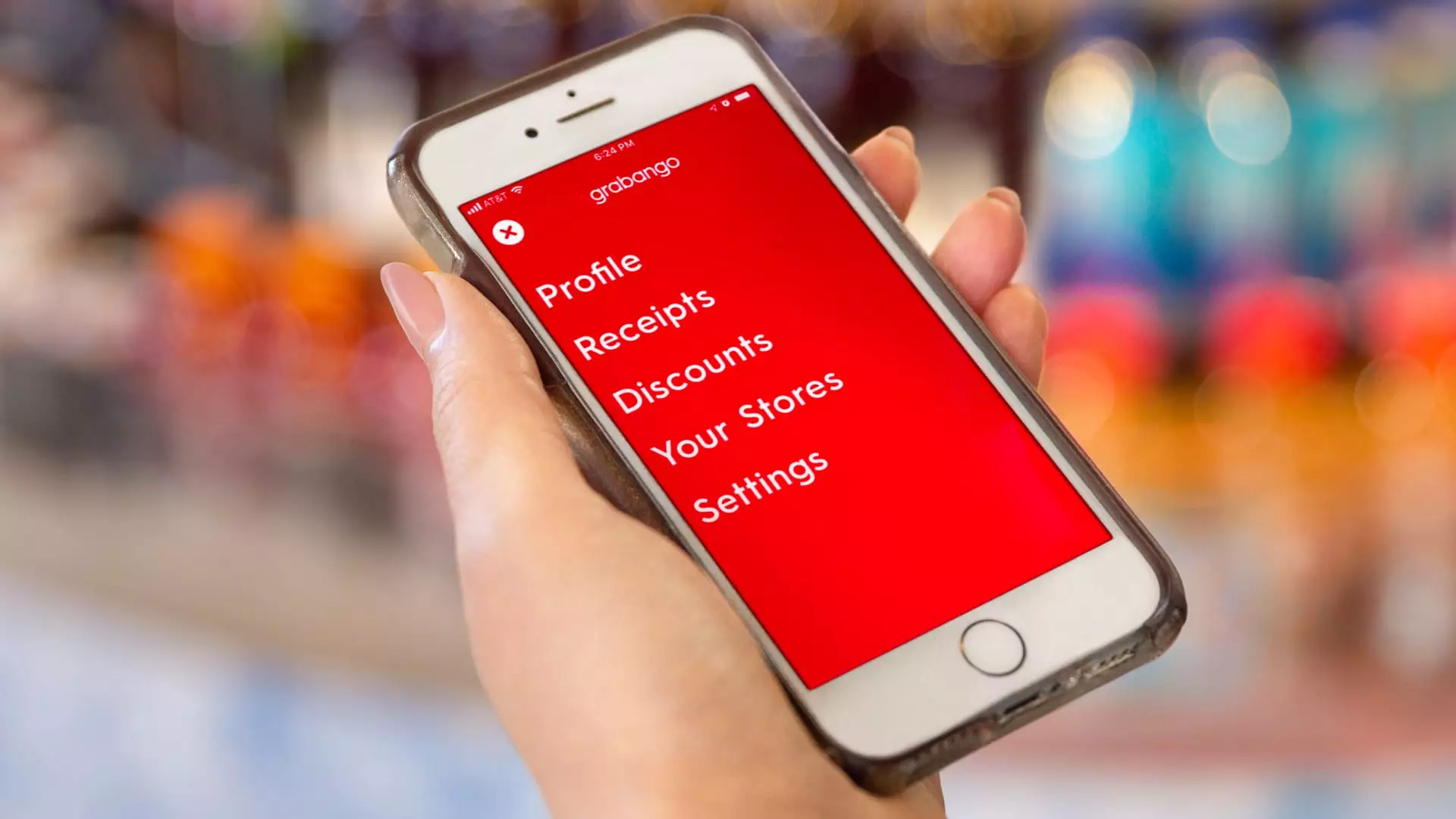

The entrepreneurial journey is fraught with highs and lows, and the recent closure of Grabango serves as a poignant reminder of the volatility within the tech startup landscape. Founded in 2016, Grabango emerged with the ambitious goal of revolutionizing retail by leveraging cutting-edge technologies such as computer vision and machine learning. The idea was simple yet transformative: to allow shoppers to pick items off the shelves and walk out without a traditional checkout process. This innovation, aimed at reducing wait times and enhancing the shopping experience, was necessary in a world that increasingly values efficiency and convenience.

Even as Grabango positioned itself as a formidable challenger to Amazon’s Just Walk Out technology, which has dramatically changed how consumers engage with retail environments, the startup found itself battling more than just competitors. A fundamental transformation in the financing landscape, particularly for startups, significantly hampered its growth and sustainability.

Despite its promising technology and strategic partnerships with well-known retailers like Aldi and 7-Eleven, Grabango struggled to maintain financial viability. Reports indicated that the company had raised approximately $73 million, bolstered by a significant funding round in 2021, led by notable backers including Peter Thiel’s Founders Fund. However, the financial picture shifted rapidly in the latter part of 2022, when investor confidence began to wane. Amid a climate where venture capital funding became increasingly scarce—especially for non-AI-related startups—Grabango’s challenge was exacerbated.

The spokesperson’s statement underscored the hard reality that, despite being a leader in checkout-free technology, Grabango could not secure sufficient capital to continue its operations. This highlights a broader trend in the startup ecosystem, where even the most promising ideas can be stifled by a lack of financial support.

Grabango’s technological approach sought to circumvent some of the limitations faced by its competitors, most notably Amazon. Will Glaser, Grabango’s founder, who also co-founded the successful music streaming service Pandora, opted against the use of shelf sensors, which he believed to be a weakness in Amazon’s system. Instead, Grabango’s reliance on advanced computer vision technology aimed to facilitate better accuracy and efficiency. Yet this differentiation was not enough to secure its longevity in the market.

As Amazon began to standardize its cashierless technologies across various venues—ranging from convenience stores to airports—Grabango’s aspiration to carve out its niche came under increasing pressure. The inherent risks of competing against a behemoth like Amazon were stark, as evidenced by Amazon’s own struggles; in April, it retracts its cashierless technology from certain locations, signaling an ongoing reevaluation of their strategy.

The closure of Grabango begs the question: What lessons can future startups learn from this experience? For aspiring entrepreneurs, the story of Grabango underscores the importance of adaptability in a rapidly shifting market landscape. The tech industry is notorious for its fickle nature, and a reliance on external funding can create an unstable foundation. Startups should prioritize building a revenue model that allows for greater independence from investor capital.

Furthermore, the interplay between technology and market dynamics cannot be overstated. Grabango’s ultimate downfall illustrates how even pioneering technologies can be rendered ineffective in an uncertain financial climate and competitive environment. The success of tech innovations may hinge not just on the technology itself but also on the timing and market readiness.

As we reflect on the story of Grabango, it becomes clear that the path of innovation is rarely linear. The closure of this once-promising startup represents both a missed opportunity in the evolution of retail and a valuable lesson in resilience amidst the challenges of entrepreneurship. While Grabango’s vision for a checkout-free future was indeed commendable, the practicalities of funding and competition ultimately proved overwhelming. In a world increasingly defined by technological advancements, Grabango’s legacy will likely serve as a touchstone for those who seek to navigate the treacherous waters of the startup realm.