In a surprising turn of events, shares of PSQ Holdings, the parent company of online marketplace PublicSquare, skyrocketed by a staggering 270.4% to reach $7.63 on the announcement of Donald Trump Jr. joining its board. This significant price increase not only reflects immediate investor reactions but also raises questions about the long-term implications of political affiliations in the corporate world.

PublicSquare operates in the commerce and payments sector, focusing on principles that resonate deeply with a considerable segment of the American populace—specifically “life, family, and liberty.” As a microcap company with a market capitalization of only $72 million, PSQ is somewhat of an underdog in a market often dominated by larger entities. The company’s financial situation, however, paints a complex picture: despite generating a net revenue of $6.5 million, it also faced substantial operational losses exceeding $14 million. This juxtaposition of growth potential against financial instability is critical to understanding the business’s future trajectory.

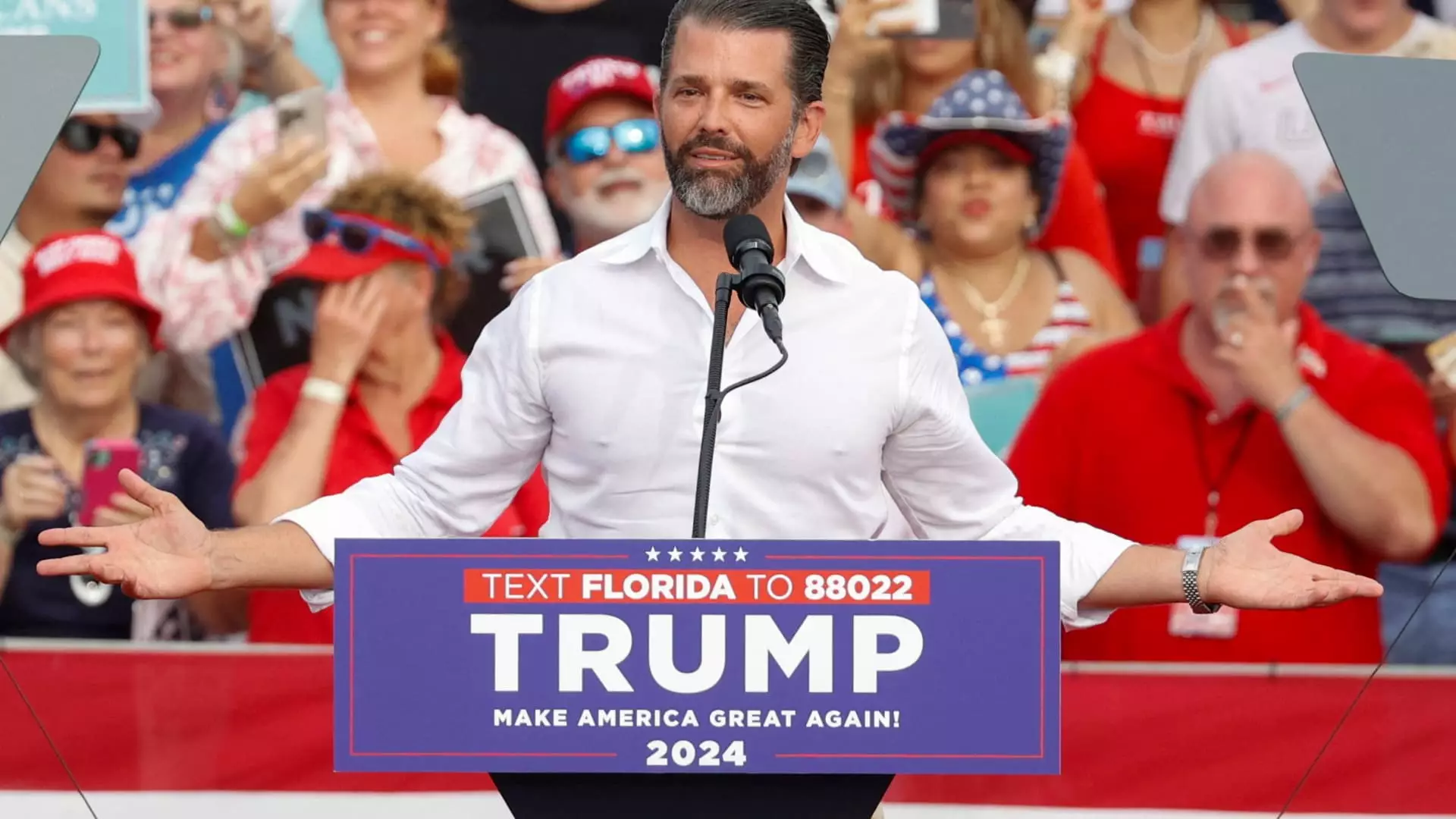

Michael Seifert, who serves as both chairman and CEO of PublicSquare, expressed confidence in Trump Jr.’s abilities, citing his strategic business experience and influence within the shooting sports sector as vital assets. Trump Jr. has articulated a vision centered around creating a “cancel-proof” economy—a concept likely to garner enthusiastic support from conservative investors wary of growing censorship and cancel culture. By leveraging his celebrity status and familial political ties, he not only legitimizes PSQ’s mission but also piques investor interest.

The pattern of political figures entering board positions and influencing stock prices is a growing phenomenon in the contemporary market landscape. Just a week prior to this announcement, Trump Jr. similarly impacted stock values of Unusual Machines, a drone company, effectively doubling its share price on that specific day. Additionally, his recent partnership with 1789 Capital—a venture capital firm targeting conservative products and investments, including forays into media—suggests a strategic alignment of business interests and political ideology.

The appointment of high-profile figures like Trump Jr. can attract significant media attention, which may bolster a company’s visibility and attract new investors. However, this also raises ethical questions about the intersection of business and politics. Will PublicSquare be able to maintain its independence and integrity as it rides the wave of Trump Jr.’s influence, or will it become overshadowed by the broader narratives surrounding its namesake?

The recent developments with PSQ Holdings and Donald Trump Jr.’s board appointment are emblematic of larger trends where political identities play an increasingly dominant role in corporate strategies. With the company’s focus on traditional American values and recent financial volatility, stakeholders will be keenly observing not only the immediate effects of Trump Jr.’s involvement but also its long-term sustainability. The unfolding drama provides a fascinating case study on how political ideologies and relationships might shape the financial landscape in the coming years.