The anticipation surrounding Tesla’s recent robotaxi event led to expectations of groundbreaking developments, but the end result was far from satisfactory. As investors digested CEO Elon Musk’s unveil of the Cybercab—Tesla’s new self-driving concept vehicle—stock prices dropped significantly, reflecting investor sentiment that the event did not deliver the anticipated advancements or clarity regarding the future of Tesla’s autonomous vehicles.

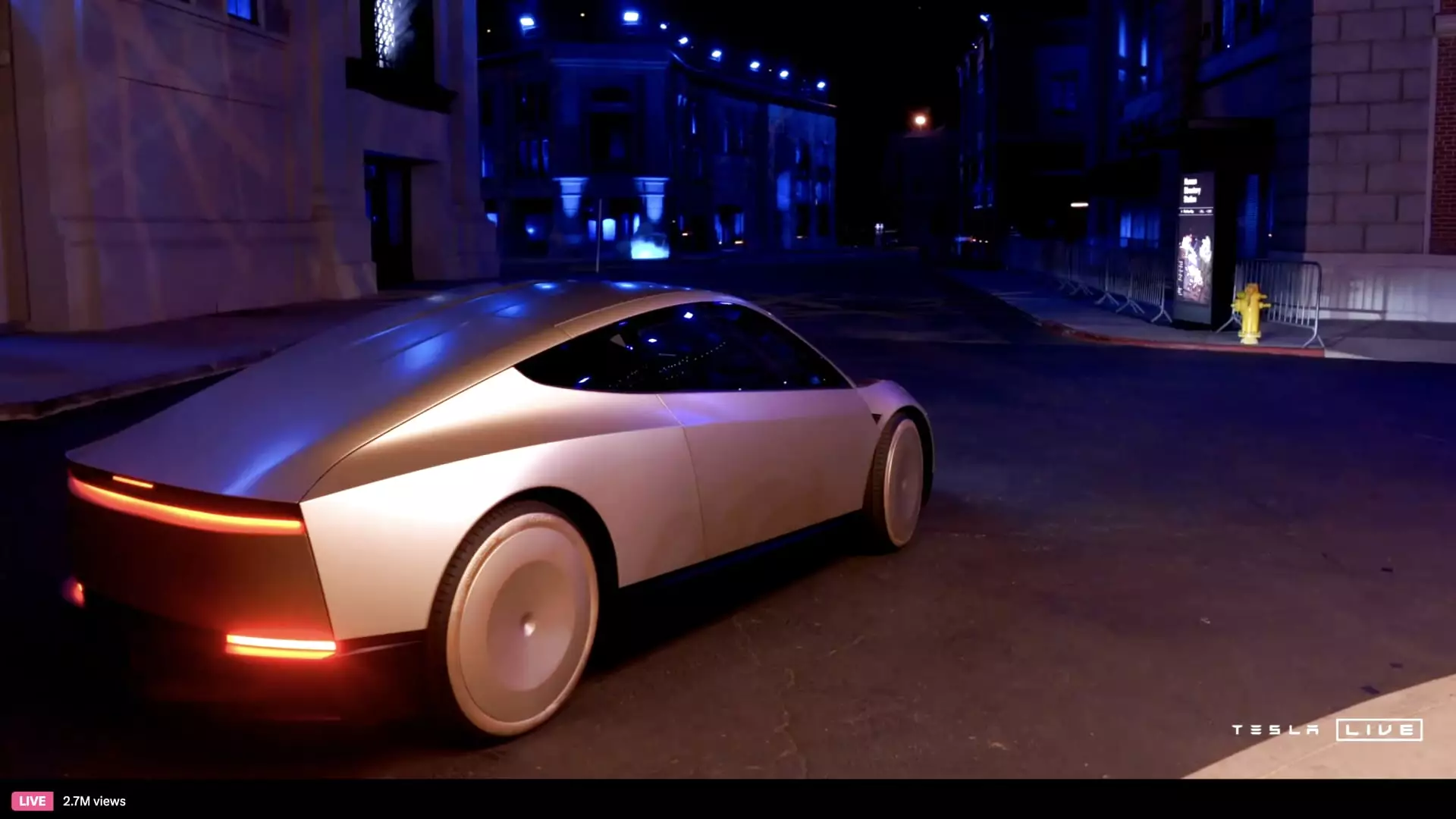

Tesla’s Cybercab appears to capture the essence of futuristic design, presenting a sleek, two-seater vehicle devoid of traditional driving controls such as steering wheels and pedals. Musk described ambitions for the Cybercab to operate autonomously, with hopes of production ramping up before 2027. However, many analysts noted that the demonstration brought more questions than answers. The lack of specificity regarding production locations and a tangible timeline left investors unsure of the immediacy or viability of the concept vehicle.

Furthermore, while Musk claimed that consumers could acquire a Cybercab for less than $30,000, the lack of detailed financial projections surrounding production, margins, and market entry led analysts to regard the stunning design more as a speculative idea than a concrete plan. Given that most technology projects require extensive revision and iteration, the timeline for a completely autonomous vehicle remains highly uncertain.

Investor reactions were immediate post-event, with Tesla’s stock plummeting by 5.8% in premarket trading. Analysts from Barclays expressed disappointment, emphasizing that the event did not showcase any immediate business advantages for Tesla and simply reiterated Musk’s long-term visions. They drew attention to the absence of updates regarding the current performance of Tesla’s Full Self-Driving (FSD) technology, which remains unproven in its “unsupervised” version.

A second opinion from Piper Sandler echoed similar sentiments, suggesting a coming sell-off as the initial excitement surrounding the event fizzled. Investors typically seek clarity, and the ambiguity surrounding the Cybercab’s launch and the future developments of FSD technology has deterred confidence.

Morgan Stanley highlighted that Musk’s delivery fell short of showcasing Tesla as an advanced AI entity. Lacking substantive updates on FSD enhancements, the event failed to capture the robust technological narrative that investors were looking for. Instead, it underscored a worrying trend for the company: a disconnect between innovative marketing and actionable plans.

The Road Ahead: Challenges for Full Autonomy

The prospect of self-driving cars entering mainstream public usage faces insurmountable regulatory hurdles centered around safety. Concerns over the reliability of self-driving technology have emerged as critical roadblocks. For instance, while companies like Waymo demonstrate successful robotaxi services, they illustrate the vast complexities and regulatory challenges that still lie in the path of widespread deployment.

The lack of clear benchmarks and updates presented by Musk during the event only exacerbated skepticism regarding Tesla’s path toward achieving autonomous vehicle capability. With regulators increasingly cautious and the automotive market rapidly evolving, confidence in Tesla’s long-term strategy will be essential for restoring investor faith.

While Tesla’s Cybercab concept symbolizes the company’s ambition to lead in the electric and autonomous vehicle markets, the recent event has raised significant doubts among investors. Without a clear plan, actionable updates, and the ability to align innovative vision with practical execution, Tesla risks losing momentum in an increasingly competitive landscape. The anticipation surrounding autonomous vehicles has not diminished, but for Tesla, the road ahead appears riddled with challenges that need immediate attention for its ambitious goals to materialize into reality. As it stands, investors will be watching closely to see if Tesla can transform its visionary promises into substantive achievements, or if it will simply remain a captivating idea without tangible results.