Reservoir Media, an influential entity in the music industry, encapsulates a multifaceted approach to handling music rights and royalties. Having established itself through a robust business model that revolves around music publishing and recorded music, this company has garnered significant attention from investors and industry experts alike. The combination of its historic catalog, growth trajectory, and strategic dealings paints a picture of a company on the brink of transformation, particularly in light of recent activist investment movements.

Operating primarily in two dynamic segments—Music Publishing and Recorded Music—Reservoir Media harnesses the power of its extensive catalog, which includes iconic compositions by legendary artists like Joni Mitchell and John Denver. The Music Publishing arm not only acquires interests in various music catalogs but also actively signs songwriters, bolstering its revenue through a blend of royalties. Meanwhile, the Recorded Music segment drives value by acquiring sound recording catalogs, discovering new talent, and facilitating the distribution and licensing of this music.

The company’s catalog is awe-inspiring; it boasts over 150,000 copyrights and 36,000 master recordings, which serve as valuable intellectual property. This expansive portfolio underscores the company’s strategy to focus on both stable and growing segments of the music industry while significantly mitigating risk by investing in established artists who produce timeless tracks. Such an investment philosophy exemplifies the trend of acquiring mature assets that promise a reliable stream of income over time.

Despite significant growth, Reservoir Media has encountered challenges in its stock performance since it went public in July 2021 through a merger with a special purpose acquisition company (SPAC). Although the company’s revenues have climbed markedly, their stock prices have not reflected this progress, resulting in a 22.24% drop since its IPO. For an organization specializing in royalty collection, stability should ideally yield increased share value as revenues grow. The current stock market valuation of approximately $493.95 million, with shares trading around $7.59, does not accurately depict Reservoir’s potential given its asset base.

Interestingly, much of Reservoir’s revenue stems from subscription streaming, which continues to be a vital force within the music industry. With projections indicating an 11.2% growth in streaming for 2023, representing $14 billion in revenue, the future appears bright. For Reservoir Media, approximately 54.17% of total revenue emanates from streaming and downloading services across both segments. However, the company’s trajectory seems incongruent with these positive shifts in the industry landscape.

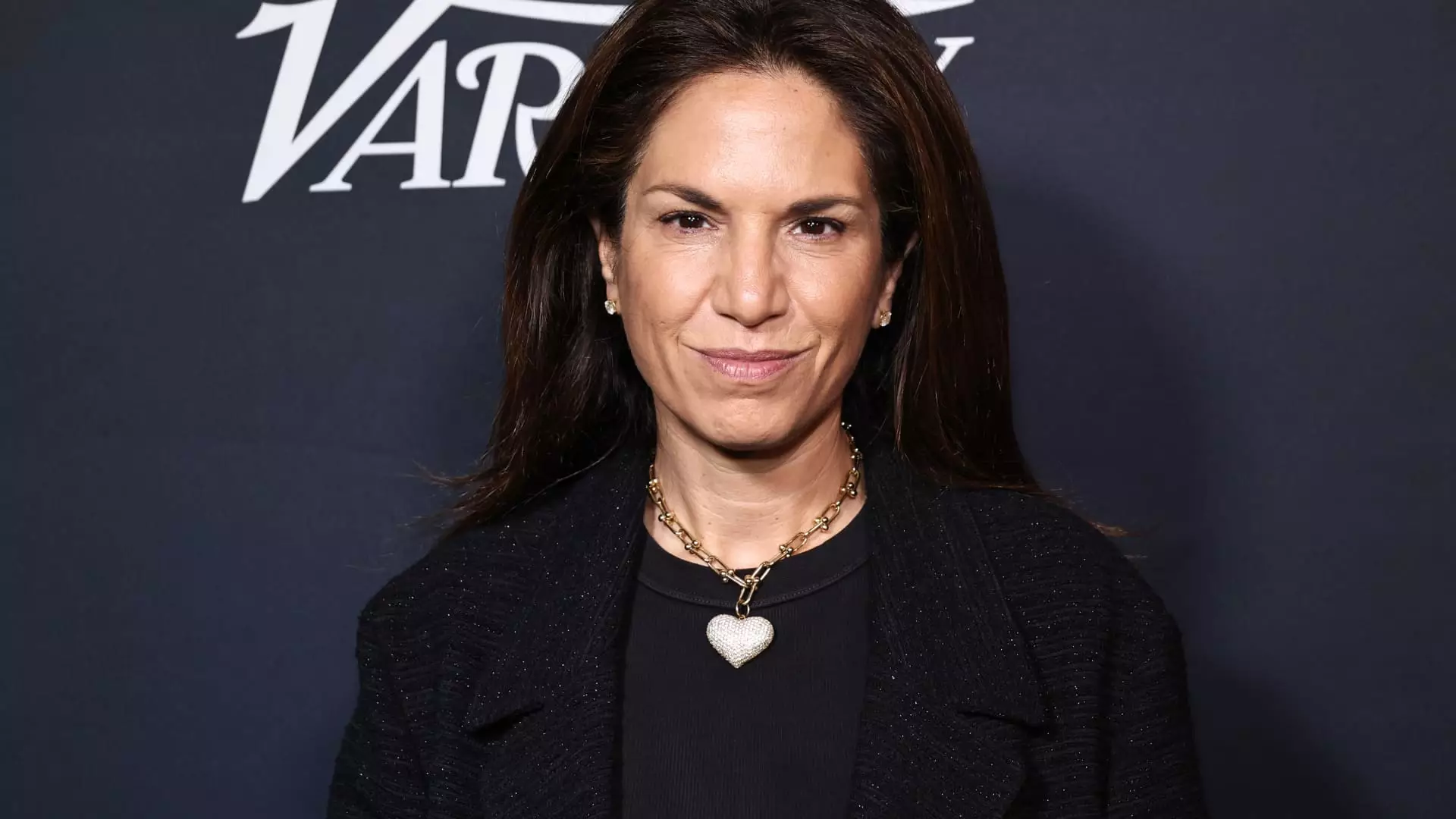

The arrival of activist investor Irenic Capital marks a critical juncture for Reservoir Media. Founded by seasoned investment managers, Irenic is known for advocating strategic reviews and calling for financial oversight within companies in which it invests. Their push for Reservoir to undertake a thorough strategic review and consider a potential sale represents an aggressive stance on the part of Irenic, who now holds an 8.14% beneficial ownership stake in Reservoir at an average cost of $6.54 per share.

While there is significant skepticism surrounding “sell the company” activism due to its often short-term focus, in this case, there seems to be a palpable rationale. Reservoir operates more as a collector of royalties than an operational traditional business entity. This unique positioning raises questions about transparency and viability in remaining public without the allure of rising capital costs.

As the music industry continues to evolve, particularly in regard to streaming dynamics and consumer preferences, the pressure mounts for Reservoir to reveal its long-term vision. Activist engagement from Irenic could spur positive changes ensuring that the company either remains competitive in its current status or evolves into a more desirable entity for potential acquirers.

With the music landscape ever-evolving, Reservoir Media finds itself at a crossroads. The transaction landscape for royalty-based companies is becoming increasingly competitive; the example of Hipgnosis’s acquisition by Blackstone for 18 times net publisher’s share (NPS) highlights the financial appetite for companies with rich catalogs. This benchmarking throws into stark relief the need for Reservoir to reassess its public status and potential partnerships.

The stakes are high; with significant institutional ownership, including the Khosrowshahi family’s notable 44% stake and Richmond Hill Investments’ 21.85%, any transition towards privatization or strategic restructuring must consider existing power dynamics.

As Reservoir Media contemplates its path forward, a combination of effective management, strategic partnerships, and potential acquisition appeals will guide its decisions. The company’s distinctive position in the marketplace, coupled with mounting pressure to enhance shareholder value, suggests that change is on the horizon. In this rapidly transforming industry, only time will tell how Reservoir Media adapts to these challenges while leveraging its impressive portfolio of timeless music assets.