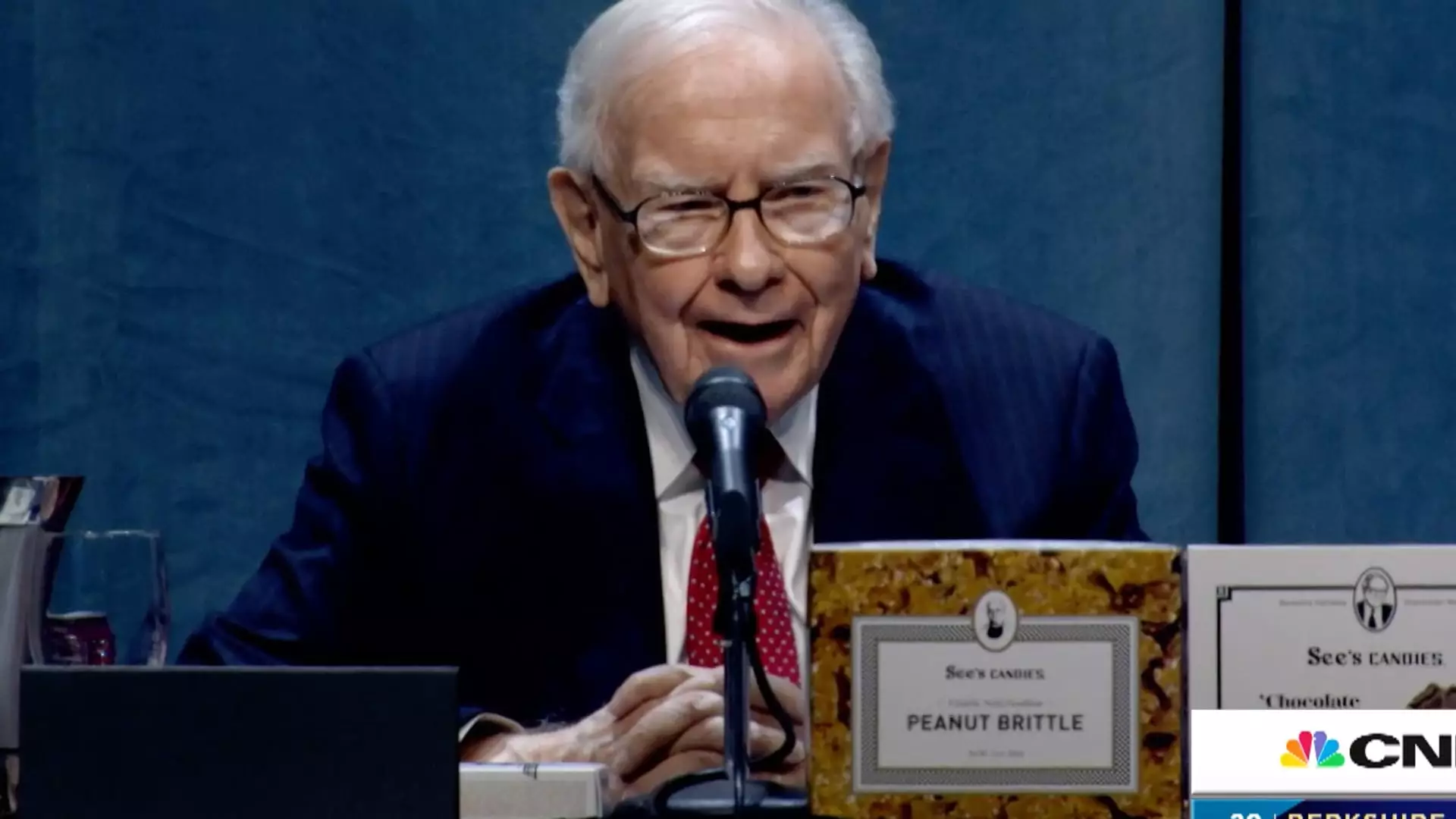

In a rare public statement, celebrated investor Warren Buffett expressed concerns regarding President Donald Trump’s tariff policies, highlighting the potential adverse effects on consumers and the broader economy. Buffett described tariffs as a financial burden, suggesting they act as a type of taxation. His comments occurred during an interview for a documentary about Katharine Graham, and he quipped, “The Tooth Fairy doesn’t pay ’em,” emphasizing that costs incurred from tariffs eventually trickle down to consumers. This perspective underscores a broader critique of trade wars: they not only affect international relations but also have direct repercussions on daily lives through increased prices on goods.

Buffett’s insights drive home the notion that while tariffs might be wielded as tools of negotiation, they can also escalate tensions akin to an act of war. By positioning tariffs in this light, he challenges the simplistic understanding of trade policies, indicating that the long-term ramifications often outweigh any short-term gains touted by politicians. The veteran investor’s reticence to provide a direct commentary on the state of the economy further emphasizes his cautious stance. It is clear that Buffett is navigating a complex economic landscape and choosing his words carefully in response to the shifting winds of trade policy.

Market Responses to Trump’s Policies

With the announcement of new tariffs on imports from Canada, Mexico, and specifically an increase on Chinese goods, concerns are growing that these measures will further exacerbate global tensions. China’s vow to retaliate could lead to a trade conflict that might backfire on American consumers and companies alike. Historically, trade wars have shown to incur heavy economic costs, and Buffett’s wariness serves as a bellwether of the uncertainty present in current market conditions.

Buffett’s actions over the past year, including the rapid divestment of stocks in favor of building a substantial cash reserve, are indicative of a strategist preparing for uncertain times ahead. This defensive posture can be perceived in two ways: either as a bearish outlook in anticipation of a downturn, or as meticulous planning in anticipation of a leadership transition within Berkshire Hathaway. Each perspective has merit, and investors—both small and large—would do well to consider the implications of Buffett’s strategy as a reflection of broader market sentiments.

Volatility and Economic Uncertainties

Market volatility is a pressing concern, exacerbated by Trump’s unpredictable policy shifts. The S&P 500’s minimal gain of approximately 1% this year suggests hesitance among investors who may be wary of the unfolding economic narrative. As discussions around potential inflation due to tariffs increase, the inherent uncertainties surrounding the economy deepen. In this environment, Buffett stands as a figure of caution, reminding investors to carefully analyze the long-term impacts of fiscal policies rather than react impulsively to short-term market moves.

Warren Buffett’s voice adds a significant layer to the ongoing discourse surrounding tariffs and economic health. His uncanny ability to distill complex issues into relatable insights serves as both a warning and a form of economic guidance as all eyes remain on the unfolding trade landscape. The investor’s reluctance to speculate too boldly on economic conditions reflects a prudent approach—an attitude that both novice and seasoned investors would be wise to embrace in times of uncertainty.