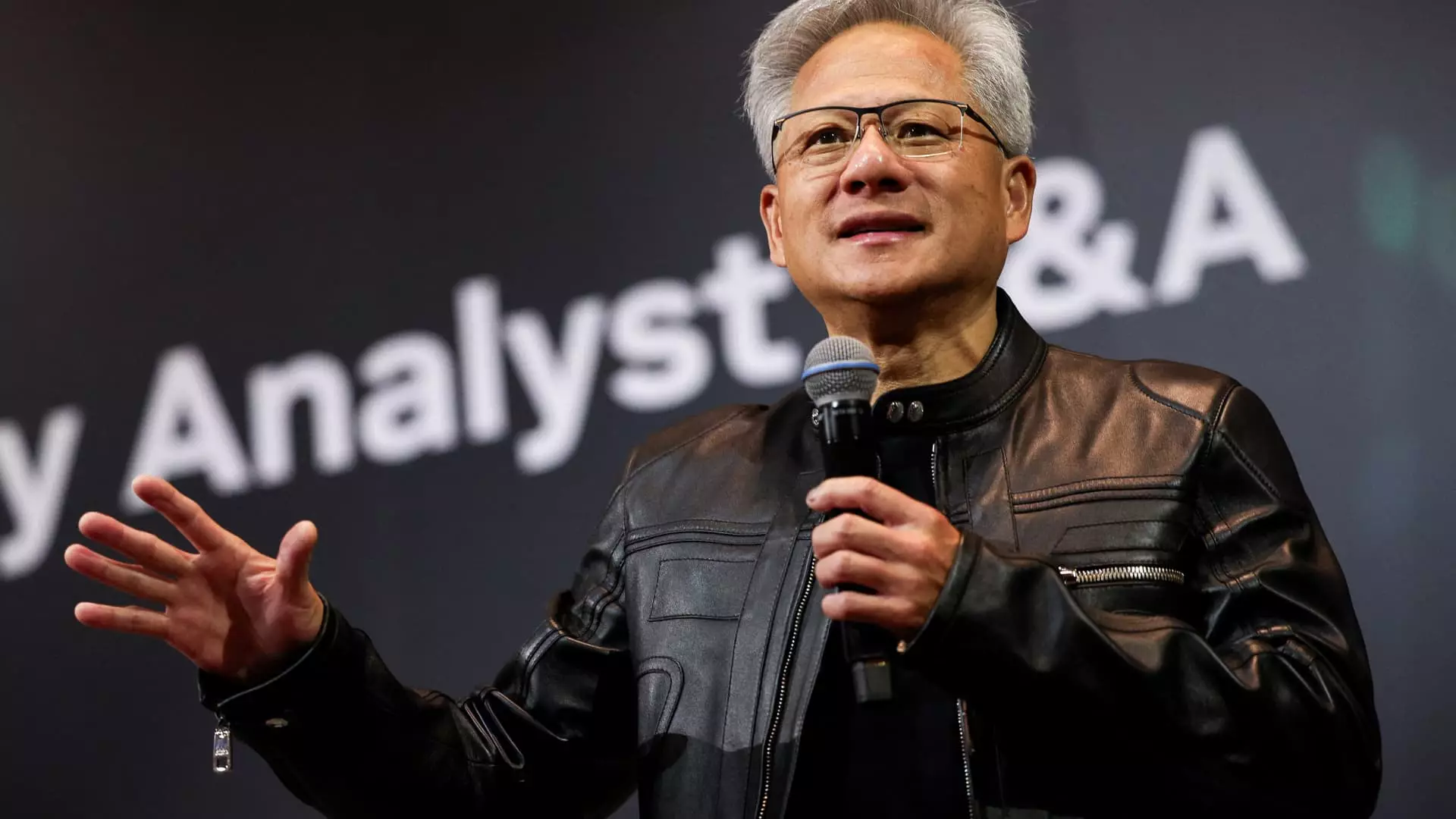

The recent and substantial sale of shares by Nvidia CEO Jensen Huang has ignited concerns far beyond mere financial management. Huang offloaded over $50 million worth of stock in just a few days, a move that cannot be dismissed as routine or solely strategic planning. When executives, especially those at the helm of trillion-dollar corporations, begin liquidating substantial portions of their holdings, it often signals a deeper caution—a warning about the company’s future prospects or a potential internal reassessment of risk. From a critical viewpoint, this pattern suggests that even the most optimistic narratives driving Nvidia’s skyrocketing valuation may be built on shaky ground. Confidence can erode quickly when insiders start divesting, especially in a sector as volatile and geopolitically sensitive as AI chips.

Huang’s stock sales should not be viewed in isolation. They occur amidst an unprecedented surge in Nvidia’s market value, driven largely by surging demand for AI technology. Yet, beneath this impressive ascent lies a fragile foundation, increasingly subject to geopolitical manoeuvres and policy swings. The fact that Huang is participating in a pre-planned, multi-million share liquidation could be interpreted as a warning that insiders are preparing for potential turbulence ahead—not necessarily signaling a crisis, but certainly indicating uncertainty about whether Nvidia’s current valuation is justifiable or sustainable.

Geopolitical Tensions and the Arms Race of AI Dominance

Adding a layer of complexity to Nvidia’s business outlook is the ongoing geopolitical drama. The US government’s recent signals to possibly approve export licenses for H20 chips to China mark a significant strategic shift. While this move might seem like a sign of easing restrictions, it cleverly masks the underlying tensions surrounding AI technology as a tool of influence and power. Nvidia, as a leader in AI hardware, finds itself caught between American national interests and China’s growing technological ambitions.

Huang’s explicit desire to sell more advanced chips to China highlights a nuanced approach—such a stance could be seen as a pragmatic step to maintain market dominance, but it also raises questions about the broader implications. Is Nvidia enabling a future where AI becomes a battleground of international influence? More critically, what does the CEO’s substantial stock liquidation say about Nvidia’s internal confidence regarding future regulatory environments? If insiders begin betting against their own company’s prospects, it hints at a looming risk—potentially regulatory, political, or economic—that could undermine their current valuations.

The Risks of Overconfidence in a Volatile Sector

Nvidia’s astronomical valuation is built largely on faith in AI’s transformative potential. Yet, this is a sector riddled with uncertainty—regulatory crackdowns, geopolitical restrictions, and technological hurdles threaten to derail even the most optimistic forecasts. When executives such as Huang start cashing out their personal holdings, it should prompt investors and stakeholders to question whether they are overestimating the sector’s resilience.

Such sales may be a prudent hedge against the inevitable volatility that lies ahead, but more often than not, they demonstrate a lack of faith in the very trajectory of growth that has elevated Nvidia to its current zenith. The AI arms race is not only fueled by innovation but by strategic positioning, and the current insider selling could be interpreted as a subtle warning: the path forward is far from clear, and the risks are mounting.

In the grand chess match of global technological supremacy, Nvidia’s recent moves suggest the company—and by extension, Huang—may be quietly preparing for a potential fallback. In a world where geopolitical decisions can quickly diminish market prospects, reliance on US-China relations remains a gamble. The lower the trust and certainty in future policies, the more precarious Nvidia’s lofty valuation becomes. It’s this delicate balancing act—between technological leadership and geopolitical vulnerability—that defines the current peril facing Nvidia’s future and, by extension, the AI industry’s broader trajectory.